…The NGX ASI has been trading within a 2.75% lowest-to highest range since mid-April (and an 8.56% range since the beginning of February)

…Average yields on Treasury bills rose by 63bps to 22.52% pa., with yields increasing across all the tenor buckets

TUE JULY 02 2024-theGBJournal| To close the first half of the year, the local bourse rebounded to 100,057.49 points with the NGX All-Share Index (ASI) gaining 32bps in the last trading session of the week.

The year-to-date return rose to 33.81%, while its market capitalisation gained N178.05 billion to close at N56.60 trillion.

The NGX ASI has been trading within a 2.75% lowest-to highest range since mid-April (and an 8.56% range since the beginning of February). For equity markets to trade flattish is the exception, not the norm.

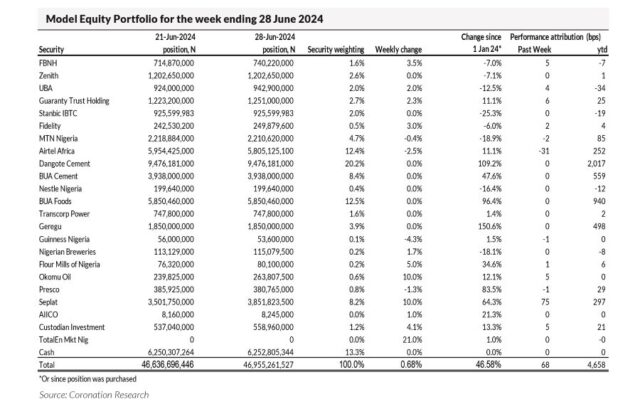

During the week, buying interest in Seplat Energy (+10.00%) and Transcorp Hotels (+9.33%) outweighed bearish sentiment in market heavyweight Airtel Africa (-2.47%) and MTN Nigeria (-6.89%) as well as Zenith Bank (-1.11%), driving of the market’s gain.

Sector indices closed mixed with the NGX Oil and Gas Index (+5.71%) leading the gainers log. This was followed by the NGX Insurance Index (+3.33%), the NGX Pension Index (+1.99%), the NGX Banking Index (+1.14%) and the NGX 30 Index (+0.42%).

On the losers’ log were the NGX Consumer Goods Index (-0.56%) and the NGX Industrial Goods Index (-0.33%).

Last week the Central Bank of Nigeria (CBN) offered N228.72 billion (US$151.94 million) worth of T-bills in its primary market auction.

Total subscriptions came in at N773.98 billion, while total sales amounted to N284.26 billion with stop rates at 16.30%, 17.44%, and 20.68% on the 91-day, 182-day, and 364-day instruments, respectively.

At the close of the week, the CBN rolled over OMO bills worth N150.00 billion across maturities of 81-day, 179-day, and 347-day, however no subscription or sale was recorded for the 81-day and 179-day bills.

Total subscription on the 347-day bill reached N295.92 billion with only N264.33 billion sold and the stop rate settling at 22.48%, adding 18bps from the previous auction.

The Debt Management Office rolled over bonds worth N450.00 billion across the 5, 7, and 9- year tenors.

The auction was undersubscribed by N144.74 billion with a bid-to-offer ratio of 0.68x down from 1.23x at the previous auction.

Total allotments were N297.01 billion with rates on the bonds settling at 19.64% (+35bps), 20.19% (+45bps), and 21.50% (+161bps), respectively.

The secondary market gave a mixed performance last week but with a bearish tilt, particularly in the Treasury bills market. Average yields on Treasury bills rose by 63bps to 22.52% pa., with yields increasing across all the tenor buckets.

Average yields in the FGN bond market declined by 2bps to 18.75% pa. driven by investors’ interest in mid-tenor bonds where average yields declined by 8bps.

-Analysis provided by Coronation Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com