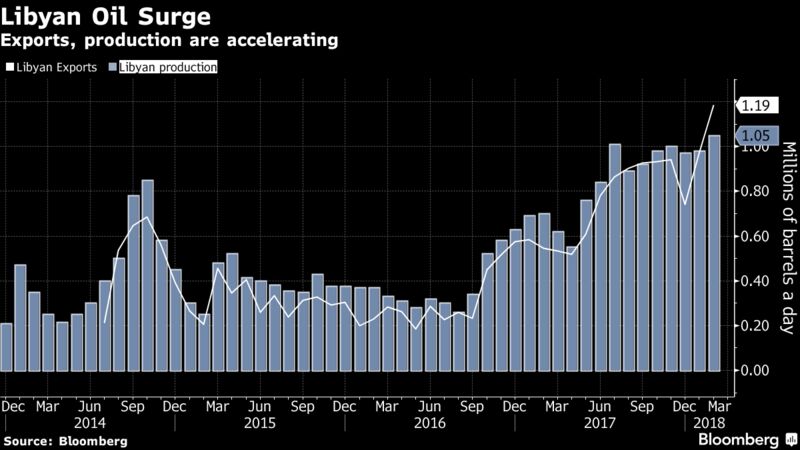

MARCH 2, 2018 – Libyan oil is gushing again with production and exports surging to the highest in years.Despite unresolved domestic conflicts that first erupted after the ouster of dictator Muammar Qaddafi, Libya has somehow found a way to get its crude flowing.

Already this year, it’s secured commitments from some of the world’s biggest energy companies, including at least three new annual cargo-lifting contracts and a $450 million oil-field investment from France’s Total SA.

Shipments from the holder of Africa’s biggest oil reserves last month jumped to 1.19 million barrels a day, the highest since Bloomberg began tracking tankers from the country in July 2014, and 22 percent up from January. Production jumped to the highest in 4 1/2 years.

Up Trend

“There are always some issues, but if you look at the term contracts being signed, Total coming back, the trend is for the return of more Libyan crude,” said Olivier Jakob, an analyst at Petromatrix GmbH in Zug, Switzerland. “On the way, there will always be some issues with protests, but the medium-term is that they will increase their production level.”

Further growth in Libyan oil supplies would take the country to a level that could test a pledge it made to the Organization of Petroleum Exporting Countries to help limit a global crude glut. Alongside Nigeria, the two African nations are meant to cap their combined output at 2.8 million barrels a day. Libya’s share of that was reported as being about 1 million barrels a day.

“The higher Libyan production goes, the more market participants will see that there is no cap for Libya and Nigeria,” said Giovanni Staunovo, commodity analyst at UBS Group AG. “The political situation is still an issue so production is likely to stay wobbly.”

PetroChina agreed an annual contract to buy Libyan crude earlier this week, the Chinese producer’s first such deal with Libya’s National Oil Corp. since 2013, according to people familiar with the matter. This followed BP and Shell who both agreed similar annual deals in January.

Total on Friday completed a purchase of Marathon Corp.’s assets in Libya for $450 million. These include a stake in the Waha Concessions, which recently increased output to 300,000 barrels a day.

Still there are risks to the growth story in Libya, said Luke Parker, a corporate analysis vice president at Wood Mackenzie.

“In recent times production has been constrained for prolonged periods due to shut-ins at export terminals,” he said. “Stability has improved, but the lack of central government means the risks of tribal disputes and labor strikes blockading critical infrastructure remain acute.”