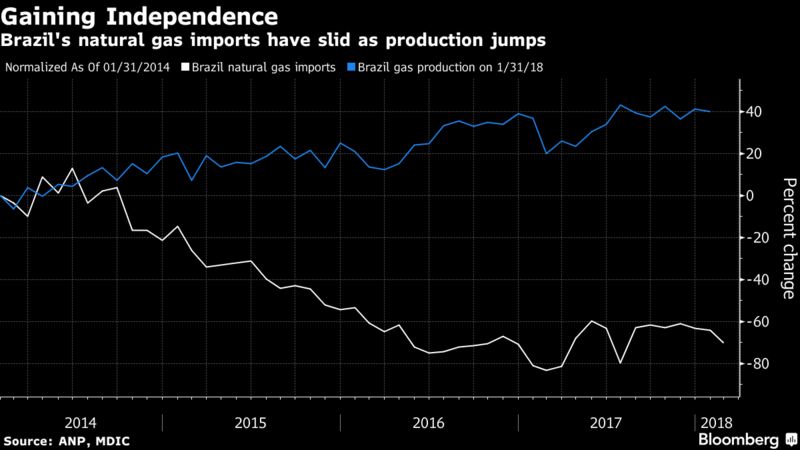

MARCH 27, 2018 – As the global natural gas trade expands amid a boom in supplies from the U.S. to Australia, at least one major energy consumer may be sitting on the sidelines: Brazil.

Pre-salt drilling has unleashed a flood of Brazilian gas supply, helping to push production almost 60 percent higher in the past five years and sending LNG imports tumbling to the lowest since 2011 last year, according to the energy ministry. The country’s demand for foreign gas fell so sharply that by the end of 2016, one of its three floating LNG import terminals had stopped converting LNG into gas for delivery to pipelines.

Though domestic gas output has soared, demand for the fuel remains a small sliver of the Brazil’s energy consumption. That’s because most of the nation’s power plants are fed by hydroelectric dams dotting the Amazon River and the Iguazu Falls, making Brazil the world’s second-largest hydropower producer, after China.

As massive LNG export terminals across the globe have rumbled to life, tipping the market into a glut, few of those cargoes have reached Brazil’s shores. LNG accounts for less than 6 percent of Brazil’s gas supply, with most imports coming from Qatar, Nigeria and Trinidad and Tobago.

American Exports

That’s despite the nation’s proximity to the U.S., which is now the fourth-largest producer of the fuel behind Qatar, Australia and Malaysia. Though Brazil bought the first cargo to sail from Cheniere Energy Inc.’s Sabine Pass terminal in Louisiana in 2016, of the roughly 300 shipments that have left the facility since then, only 10 have reached the country. A Cheniere spokesman didn’t immediately respond to a request for comment.

While two more LNG plants on the U.S. Gulf Coast are set to start up by the end of next year, most of those supplies are likely to head for Asia — especially China, where demand has spiked as government policies aimed at curbing pollution force coal plants to shut — and Mexico, where gas-fired power plants are also proliferating.

Brazil’s gas independence, meanwhile, is creating a conundrum for Bolivia, which supplies 83 percent of its neighbor’s imports of the fuel. A long-term contract to import as much as 30 million cubic meters a day from Bolivia will expire in 2019 and may be cut in half after that. That’s prompted Bolivia to accelerate its search for alternate markets, such as Argentina, according to Ieda Gomes, senior visiting research fellow at the Oxford Institute for Energy Studies.

Bolivia’s energy ministry didn’t respond to a request for comment.

Brazil will continue to import considerable volumes of Bolivian natural gas and LNG through 2026, a representative of the nation’s energy ministry said in an emailed response to questions. But to be more competitive in Brazil, LNG suppliers will have to lower prices or offer more flexible contracts, the ministry said. Brazil has no long-term contracts for the fuel and gets supply in the spot market.

Despite the drop in gas imports, Petrobras’ plans to sell energy assets to reduce crushing debt should create more opportunities for foreign investors to gain a foothold in Brazil. The company, which was virtually a monopoly from production to distribution until a couple of years ago, is now selling plants, production fields and thousands of miles of pipelines as Chief Executive Officer Pedro Parente rushes to meet his divestment target before an unpredictable presidential campaign later this year.

“There are new opportunities to develop a more open market for natural gas, more competitive and with a greater number of players,” Felipe Kury, a director at the National Petroleum Agency, ANP, said at an event in Rio March 19.