MON, JULY 10 2023-theGBJournal |By Destination of Investment, Lagos state remained the top destination in Q1 2023 with US$704.87 million, accounting for 62.23% of total capital investment in Nigeria, followed by Abuja (FCT), valued at US$410.27 million (36.22%), according to latest data report by the National Bureau of Statistics (NBS).

The data shows also that Citibank Nigeria Limited ranked top in Q1 2023 with US$424.13 million (37.45%).

This was followed by Standard Chartered Bank Nigeria Limited with $360.33 million (31.81%) and Stanbic IBTC Bank with US$151.85 (13.41%).

Meanwhile, Total capital importation into Nigeria in Q1 2023 stood at US$1,132.65 million, lower than US$1,573.14 million recorded in Q1 2022, indicating a decrease of 28.00%.

When compared to the preceding quarter, capital importation rose by 6.78% from US$1,060.73 million in Q4 2022.

The largest capital importation during the period was received from Portfolio Investment, which accounted for 57.32% (US$649.28 million) of total capital imported in Q1 2023.

This was followed by Other Investment with 38.31% (US$435.76 million) and Foreign Direct Investment (FDI) with 4.20% (US$47.60 million).

Disaggregated by Sectors, capital importation into the banking sector recorded the highest inflow of $304.56 million, representing 26.89% of total capital imported in Q1 2023. This was followed by capital imported into the production sector, valued at US$256.12 million (22.61%), and IT Services with US$216.06 million (19.08%).

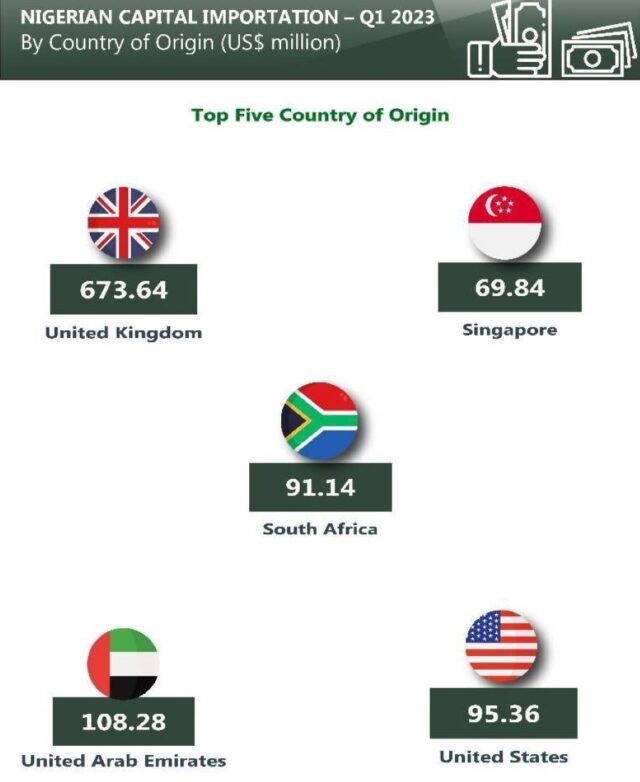

Capital Importation by Country of Origin reveals that capital from the United Kingdom ranked top in Q1 2023 with US$673.64 million, accounting for 59.47%. This was followed by the United Arab Emirates and the United States valued at US$108.28 million (9.56%) and US$95.36 million (8.42%) respectively.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com