TUE, 27 SEPT, 2022-theGBJournal| The past few months have not been rewarding for Nigerian equity investors as increasingly hawkish monetary policy and the resultant rise in market interest rates continue to dampen sentiment on the NGX Exchange.

Last week, the NGX ASI fell for the third successive week and by the most in five weeks. With less than a week left in the quarter, it is now on track to record its first quarterly loss since Q2 2021 and the largest since Q1 2020.

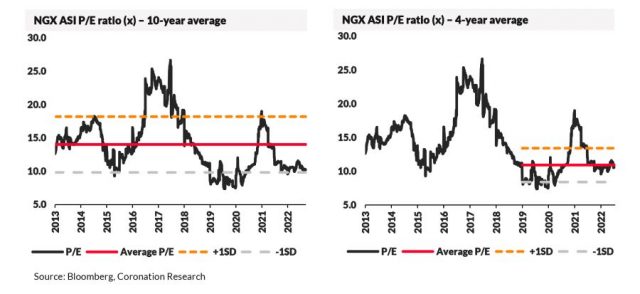

Consequently, the valuation of Nigerian equities has come-off from its recent peak, following the ongoing market correction and a 44% improvement in earnings this year. Currently, the NGX ASI is trading at a price-to-earnings (PE) multiple of 10.1x, moderating from its 2022 high of 11.6x.

In the long-term context, the PE of the NGX ASI is well below its 10-year average of 14.0x. In fact, it is 1 standard deviation below, signaling that the market is severely undervalued. In this situation, barring PE contraction below historical norms or earnings deterioration, the ASI would be expected to rise. In a shorter-term context, the NGX ASI also looks slightly undervalued compared with its 4-year average PE of 10.9x.

Our study on the Bond Equity Earnings yield Ratio (BEER) paints a similar picture at the moment. The bond equity earnings yield ratio (BEER) is a metric that is often used to evaluate the relationship between the earnings yield of a stock market (the inverse of the price-to-earnings ratio) relative to bonds. A number above 1 means that the equity market is overvalued, while below 1 means that equity market is undervalued.

At 0.7x, the BEER for the NGX ASI to the 1-year T-bill is at similar levels seen during most of 2020 and in the second half of 2021 when marketrates were falling.

However, although the ratio is below 1, the trend in the reading has been northwards over the last few months, and with the Central Bank of Nigeria (CBN), akin to global central banks, expected to hike interest rates further to reign in inflation, valuations of Nigerian equities could see a further de-rating.

The NGX All-Share index is cheap, and valuations are likely to become more attractive in Q4 2022. As a result, we are likely to see renewed interest from long term investors, especially as earnings continue to improve (analysts’ earnings expectations are up 7% since the end of June).-With Coronation Research

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com