…Investors in Nigerian sovereign Eurobonds can count themselves lucky. The country is not overburdened with Eurobond issues, with an outstanding total of US$15.0bn that looks small in relation to its US dollar GDP

…The lesson is that, when it comes to Sub-Saharan sovereign Eurobonds, the market judges them on a country-by-country basis

…Risks remain, as always, but we believe that Nigerian sovereign Eurobonds continue to represent good value

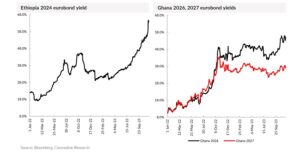

TUE, NOV 21 2023-theGBJournal|Holders of Sub-Saharan Africa Eurobonds have had a difficult time of late. Just over a year ago Ghanaian Eurobonds reached extraordinary yields as the country went into a restructuring program with the International Monetary Fund (IMF).

Lately it has been the turn of Ethiopian Eurobonds to hit the storm, with the yield of its 2024 US dollar-denominated bond hitting 63.5%. What are the implications for Federal Government of Nigeria (FGN) Eurobonds?

To begin with, Ethiopia, Ghana and Nigeria are very different issuers. Ethiopia is a rarity in the market and has one Eurobond outstanding, issued in 2014 with a 10-year tenor. Ghana is a familiar name in the Eurobond market with over a dozen issues outstanding.

Only a few years ago, Ghana was seen as a smarter issuer than Nigeria. There are distinct seasons for issuing Eurobonds and timing is everything. In early 2020 Ghana issued three Eurobonds, raising a total of US$3.0bn, just before the Covid-19 pandemic sent a wrecking ball through global markets.

Meanwhile Nigeria’s legislature was still approving its Eurobond issue, and by the time the issuing authority received the rubber stamp the party was over. International investors wanted safety above yield, and it was too late for Nigeria to issue.

In 2021, and once global markets had recovered, Ghana again issued Eurobonds, raising more than it had the previous year.

Nigeria, comparatively late, raised a total of US$5.25bn in late 2021 and early 2022.

Then, as we know, Ghana’s public finances ran into trouble, precipitating the intervention of the IMF later in the year, and a restructuring of the government’s debt both in domestic Cedi and in US dollars. The lesson for Eurobond investors is that, when it comes to macroeconomic management, things can go badly wrong in just a couple of years.

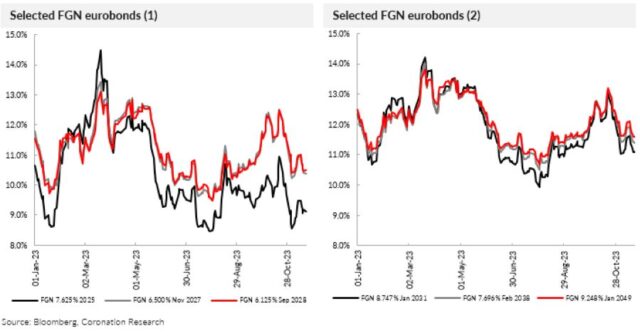

Investors in Nigerian sovereign Eurobonds can count themselves lucky. The country is not overburdened with Eurobond issues, with an outstanding total of US$15.0bn that looks small in relation to its US dollar GDP (a metric Eurobond investors reference).

Although recently-announced plans are to securitise future US dollar cash flows owing to the Nigerian government (money that would otherwise be available to service Eurobonds, among other US dollar debts) in order to support foreign exchange reserves, the Eurobond market does appear worried; Nigerian yields have tightened recently.

As for Ethiopia, it announced recently a restructuring of foreign debt, including its single Eurobond mentioned above. The yield on this US$1.0bn deal reached 63.5% recently. And, further afield, Zambian debt is also being restructured at this time.

The lesson is that, when it comes to Sub-Saharan sovereign Eurobonds, the market judges them on a country-by-country basis, and the more a sovereign issuer attempts to address its macroeconomic woes the better the market responds.

Risks remain, as always, but we believe that Nigerian sovereign Eurobonds continue to represent good value.-With Coronation Research (Coronation Asset Management)

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com