…Perhaps this is a signalling tool by the CBN to shift attention away from the parallel market

FRI, OCT 13 2023-theGBJournal| In a circular dated 12 October, the Central Bank of Nigeria (CBN) highlighted six measures, restating its commitment to boost liquidity in the Nigerian Foreign Exchange Market (NFEM).

While most of these highlights are the CBN’s restatement of commitments to previous communications, the most significant highlight for us is the CBN’s removal of the ban on some items from accessing the NFEM.

Specifically, the CBN stated that importers of all the 43 items previously restricted by the 2015 Circular referenced TED/FEM/FPC/GEN/01/010 and its addendums can now purchase foreign exchange in the NFEM.

In our view, while this is another step forward, we think FX liquidity should take prominence to avoid further FX pressures at the official and parallel markets, more so that the FX queue will now be longer at the official market without liquidity.

Perhaps this is a signalling tool by the CBN to shift attention away from the parallel market and reduce the pressure of the official market playing a catch-up game with the unofficial exchange rate.

Hence, in terms of impact, we think FX pressures will increase in the official market in the near term, while the parallel market rate is likely to appreciate as the importers of these 43 items move to the official market.

Consequently, in the near term, we expect the official exchange rate to depreciate towards the parallel market while the parallel market rate appreciates towards the official market such that the two rates find a new middle ground based on current FX liquidity conditions.

On the official exchange rate, we believe that with the current FX liquidity dearth and limited CBN’s FX interventions, the odds do not favour a stable exchange rate at the existing N750.00/USD – N780.00/USD.

However, when the market realises that FX supply is still minimal at the official market, importers will return to the parallel market to fulfil their FX obligations. The preceding will lead to another round of FX pressures in the parallel market.

While removing demand-side restrictions is necessary, we believe that significant FX liquidity is sufficient to complete the reform process, giving the local currency a breathing space.

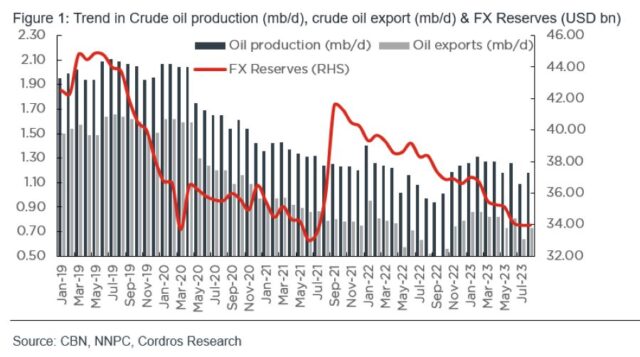

To this end, we think that higher short-term interest rates, embarking on an IMF Stand-By Arrangement (SBA), and ramping up crude oil exports to a range of 1.50mb/d – 1.70mb/d (8M-23 average: 783.75kb/d) amid the supportive oil prices are paramount to boosting short term FX liquidity and closing the parallel market premium.

Over the medium-to-long term, diversifying the economy’s export base is paramount to solving the reoccurring exchange rate issues.

The country needs to look beyond crude oil and earn more from stable exports. We conclude with a famous saying that “the ideal time to move on the exchange rate never comes, a worst time always does”.- Insight is provided by Cordros Research

Twitter(X)-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com