MON, AUGUST 14 2023-theGBJournal |The month of July presented a dynamic tapestry of market movements in Nigeria’s fixed-income landscape, oscillating between bullish momentum and bearish bias.

A Research Analyst at an Investment Bank, helped us at theGBJournal delve into the key events that shaped the month and offer insights into what the future may hold for investors.

Bullish Start and a Surprising Turn

July commenced with an air of optimism, as a bullish momentum permeated the market.

However, this positive sentiment was abruptly interrupted following a significant auction on the 17th of July, orchestrated by the Debt Management Office (DMO).

The outcome of the auction proved to be a shocker, with N656.74 billion sold against an offer of N360 billion. Notably, the 53s stood out as the most sought-after securities.

The stop rates for the 29s, 33s, 38s, and 53s closed at 12.50%, 13.60%, 14.10%, and 14.30%, respectively.

Treasury Bills Market: Seeking Stability Amidst Volatility

In contrast to the bond market, the treasury bills market experienced a tussle between bullish and bearish sentiments.

Despite buoyant system liquidity, market players exhibited an affinity for bills. The shorter tenured maturities garnered attention, with trades executed at the 3% handle.

Towards the close of the month, renewed interest was observed in the 25-July-24 bill,

spurred by the looming CRR debits.

A Month of Auctions

The treasury bills market witnessed two auctions in July, each leaving its mark on the market sentiment.

During the first auction on the 12th of July, the DMO offered and allotted N141.76 billion against a subscription of N691.85 billion.

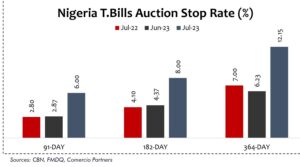

Notably, the stop rates declined across the curve, indicating investor appetite for shorter tenors.

The second auction on the 26th of July saw the DMO offering and selling N264.31 billion against a subscription of N398.15 billion.

However, this time, the stop rates witnessed an uptrend, signalling a shift in investor sentiment.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com