THURS, JULY 27 2023-theGBJournal |Inclusion for all, the pro-poor advocacy platform, successfully hosted the first edition of the “Inclusion for all Dialogues” event on 26th July.

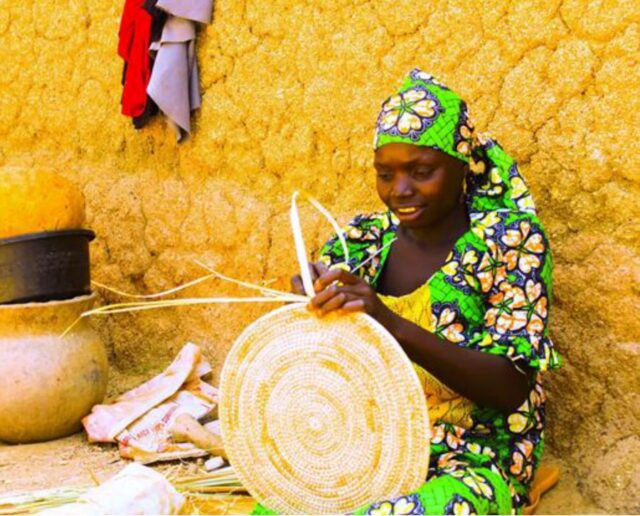

The event, which focused on “Digital ID for the Last Mile – Enabling Access to Digital ID for Rural Female Agricultural Workers,” brought together a selection of stakeholders to discuss and address the digital inclusion barriers faced by rural women in Nigeria’s agricultural value chain.

I4ALL aims to use data evidence to deepen understanding of the challenges faced by impoverished populations and collaborate with multiple stakeholders to advocate for their removal.

The ultimate objective is to drive increased ownership and usage of digital financial services, amongst the most excluded groups thus reducing financial exclusion nationwide.

Zaina Sore, Head of Capacity Development at IITA presented the findings from the targeted research study on “Access to Identity, Empowerment, Livelihood, and Financial Inclusion of Rural Female Agricultural Workers and Traders in Nigeria.”

She emphasised the significance of digital identity in empowering these women and transforming their livelihoods. Stating that “Access to national identification as a means for greater financial inclusion is critical for women in remote rural areas.”

As many of them engage in different agricultural activities and trading particularly in the informal sector, it is important that we better understand their needs and challenges to tailor the services that will lead to greater inclusion and economic empowerment.

The study, commissioned to IITA by I4ALL, was carried out in the first quarter of the year in Kano, Oyo and Rivers States; revealing some new insights and validating pre-existing data insights from I4ALL’s analysis of the 2020 Enhancing Financial Innovation and Access (EFInA) A2F (Access to Finance) dataset.

For instance, Kano State recorded higher levels of NIN ownership (77%) among the respondent groups compared to Oyo (58.1%) and Rivers (46.6%) contradicting our hypothesis of lower enrolment rates in the North.

However, the research highlighted how socio-cultural norms can be used as a deliberate strategy to drive female enrolment in the North.

The barriers to NIN enrolment remained consistent, from the cost of transportation to distance from enrolment centres and tedious enrolment processes.

Commenting on the findings, Chinasa Collins-Ogbuo said: “Universal access to formal identification requires an intentional focus on the most vulnerable Nigerians – likely to be poor female farmers in rural communities.

Thus far, NIMC has done a great job with the momentum achieved towards ID enrolment of Nigerians, and it must be maintained. That said, reaching the last mile is the most challenging part; and specific and targeted approaches must be designed and implemented to reach them successfully and leave no one behind”.

The NIMC Identity Strategy clearly recognizes the need to ensure that excluded populations are included in the enrolment process, and this research reinforces that need, demonstrating the urgency for action.

The poorest excluded populations are most often the hardest to reach, and can be the most resistant to participation, but stand to gain the most from the range of government and financial services that inclusion enables.

To achieve NIMC’s ambitious enrolment targets, all relevant stakeholders across public, private and grassroots must work together to ensure that the enrolment system reaches those who need access to the services the most – the vulnerable and marginalised.

The event featured an esteemed line-up of panelists who lent their expertise and insights to the event including, Professor Janice Olawoye – Lead Research Consultant from the International Institute of Tropical Agriculture (IITA), Dr. Osasuyi Dirisu – Executive Director, Policy Innovation Centre (PIC), Ms. Uche Chigbo – Director Operations, National Identity Management Commission (NIMC) and Dr. Paul Oluikpe – Head, Financial Inclusion Delivery Unit, Central Bank of Nigeria.

The insightful panel discussion shed light on the supply and demand side barriers to digital ID ownership for rural female agricultural workers and how they can be overcome to facilitate their active economic inclusion and participation leveraging technology.

Also in attendance were notable personalities from various State Governments including Mrs. Omotayo Adeola the SA, Trade & Investments Ekiti State Government, representing His Excellency, Governor Biodun Oyebanji of Ekiti State, Mr. Osa Bazuaye, Head of Data Agency, Edo State Government, representing His Excellency, Governor Godwin Obaseki of Edo State and Dr. Zayyad Tsiga, Executive Secretary of the Kaduna State Residents Identity Management Agency (KADRIMA).

Chinasa Collins-Ogbuo, convener and head of Inclusion for all; described the event and its relevance stating – “Our aim is to cultivate a strategic platform of cross-cutting actors with a shared goal to uncover the links that exist between income level, identity ownership and financial inclusion in order to identify opportunities to accelerate the pace of digital financial inclusion”

To further contextualise the event, Director General of NIMC, Engr. Aliyu Aziz, delivered the keynote address, focusing on the progress made in National Identification Number (NIN) enrolment in Nigeria, the challenges faced, and the approaches in consideration to overcome them. He underscored the importance of data evidence in shaping policies and highlighted key findings from the summary study report.

Engr. Aziz reiterated the persistent enrolment gender gap, stating that “Of the over 101 million registered persons to date, only 44% are females in spite of the notion that there are more women than men. Flowing from the surveys and advise from Inclusion for all at Africa Practice, NIMC has taken some actionable steps that have profound implications on the ID project.”

The Inclusion for all Dialogues event highlighted the importance of collective efforts in creating an inclusive and equitable society. Chinasa reinforced this, stating that, “by empowering rural female agricultural workers with digital identification, we can unlock their potential, enhance economic productivity, and drive positive change for the entire nation.

I4ALL remains committed to its mission of fostering financial inclusion for all Nigerians and will continue working tirelessly with partners, stakeholders, and policymakers to address these pressing challenges.”

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com