…The borrowings to be made in H2-24 from the domestic market are expected to be quite significant

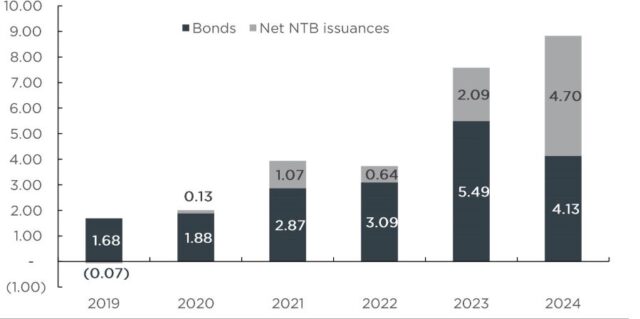

THUR JULY 04 2024-theGBJournal| As expected, the level of borrowings by the federal government in H1-24 was significant, as aggregate borrowings in the capital market settled at NGN8.48 trillion (vs NGN7,58 trillion trough 2023FY), between bond auctions and net treasury bill issuances.

Specifically, bond issuances settled at NGN3.83 trillion (69.7% of the volume borrowed through 2023FY, while net primary market treasury bills issuances settled at NGN4.65 trillion (122.9% higher net NTB issuances for 2023FY).

This level of borrowings was expected given the significant deficit profile and cessation of ways and means drawdowns.

The National Assembly (NASS) passed a total budget of NGN28.80 trillion (including GOEs and project-tied loans) into law in December 30, 2023. The NASS raised the budget revenue by 6.99% to NGN19.6 trillion.

Based on the approved budget, the deficit was meant to be financed by a combination of domestic borrowings (NGN6.04), foreign borrowings (NGN1.77 trillion), multilateral/bilateral loan drawdowns (NGN941.19 billion, and privatization proceeds (NGN298.49 billion).

Consequently, based on the amount to be raised domestically, it may seem that the federal government would slow down the pace of borrowings going forward.

Analysts at Cordros Research, however notes that a portion of the borrowings during H1-24 was utilized to pay off excess ways and means borrowings from 2023 (NGN4.83 trillion).

Adjusting that amount, the borrowings to be made in H2-24 from the domestic market are expected to be quite significant.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com