MON 14 MARCH, 2022-theGBJournal| Last year the Nigerian mutual fund industry suffered its first contraction in five year with its total assets under management (AUM) contracting by 10.6%.

So far this year, by contrast, its total AUM have risen by 4.3%. The prospects for the rest of the year look good. What is driving flows out of – and back into – mutual funds?

This year, while inflation has continued to decline, primarily due to base effects, 1-year T-bills yield 5.02% (end-February) with inflation still in double digits at 15.60% (February). This has presented challenges for fund managers seeking to attract money into Money Market and Fixed Income funds. The differentiating factor between funds today is how skillfully their managers position portfolios as interest rates change.

Risk appetite has sent the NGX All-Share Index up 11.05% year-to-date. This rally has been driven by new NGX Exchange listings (e.g., BUA Foods), better-than-expected Q4 earnings, positive earnings expectations and corporate actions, as well as investors taking positions ahead of FY 2021 dividend payments.

In Coronation Research report, 2022 Investment Strategy, Optimising Risk and Returns, (22 February), they made a case that equities continue to look attractive with a few stocks, notably among the banks and telcos, generating higher dividend yields than the 1-year T-bill.

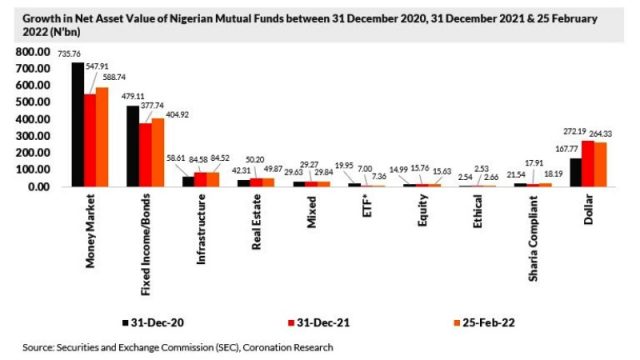

Following the recent reclassification by the Securities and Exchange Commission (SEC), there are now 10 categories of publicly listed mutual funds: Money Market Funds, Fixed Income/Bond Funds, Infrastructure Funds, Real Estate Funds, Mixed Funds, Exchange-Traded Funds (ETFs), Equity Funds, Ethical Funds, Sharia Compliant Funds and US Dollar Funds.

This reclassification was necessary because US dollar funds used to be listed under Fixed income and Bond funds, as we explained in our report The rise of dollar mutual funds, 1 November).

However, in this same period, other categories of funds, notably US dollar-denominated funds (+62.24%), Infrastructure funds (+44.32%), Real Estate funds (+18.66%) and Equity funds (+5.14%), grew, showing the increasing appetite on the part of investors for risk assets. (Note that some of the growth was accounted for by the performance of the underlying assets.) So far this year, the total combined Net Asset Value of all the regulated mutual funds is up 4.34%.

What are the prospects for the rest of this year? Coronation Research view is that risk assets will remain in vogue as long as risk-free returns continue to fall.

‘’So, we expect to see money going into the above-mentioned categories of funds. By contrast, our core view on market interest rates is that these are likely to rise this year (Coronation Economic Research, Blend of Optimism and Uncertainty, 14 February), and so we expect risk-free returns to improve. We therefore expect mainstream Money Market and Fixed Income funds to attract money throughout the year.’’- With Coronation Research Report

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com