WED, JAN 17 2024-theGBJournal|Last week the CBN held two auctions that give us a good indication of where savings rates are headed in 2024, in our view. To get an indication so early in the year is unusual.

To begin with, we know that the Governor of the CBN, Dr. Yemi Cardoso, wishes to address price stability, i.e. inflation.

One way of doing this is to raise Naira interest rates because raising rates puts a brake on borrowing and the supply of money to the economy. It is when money is supplied but not being used efficiently that inflation takes off.

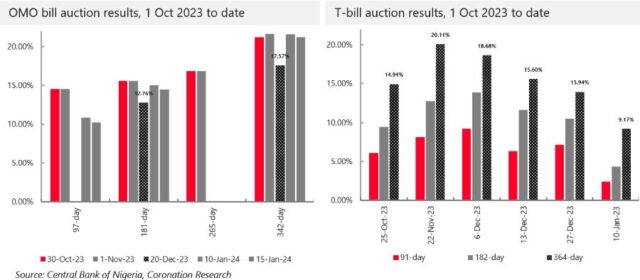

In late October the CBN signaled its intent with an open market operation, auctioning its OMO bills to banks at a tempting rate that was designed to suck money out of the banking system (the technical word is sterilisation). The 362-day OMO bill was sold at a yield of 16.92%. Then, in November, the CBN held an auction of T-bills that achieved a yield of 20.11% at the 1-year maturity.

While an OMO bill auction is designed to draw money out of the banking system, the effects of a successful T-bill auction are different. A T-bill auction funds government (in which case the money flows back into the economy) while encouraging savers to save money either with direct T-bill purchases or subscriptions to Money Market Mutual funds.

But in either case, OMO or T-bill auction, money is being locked up in securities that might otherwise hit the street and influence prices.

In December T-bill rates fell, with secondary market yields drifting down to 11.77%. With reported November inflation at 28.20% year-on-year, where was the assault on inflation?

The answer came last Wednesday. The CBN’s OMO auction achieved a 1-year yield rate of 21.56%, in line with its earlier auctions rates since late October; N350.0bn (US$393.3m) was removed from the banking system in a few hours.

The CBN’s auction of T-bills that afternoon, by contrast, achieved a yield of 9.17% for 1-year paper. Quite a difference.

What does this mean for Nigerian savers? Ordinary Nigerian savers cannot buy OMO bills since the auctions are available to banks and to foreign portfolio investors.

There can be indirect effects, whereby a high OMO rate influences banks’ own cost of funds, which can be seen in the Nigerian interbank rate. This has been high since last October.

It can encourage banks to be generous when giving deposit rates to customers, particularly when professional asset management companies (as Financial Institutions) gather customers’ money to place deposits in large sums.

For the most part, ordinary Nigerian savers, as well as pension funds and mutual funds, purchase T-bills and Federal Government of Nigeria (FGN) bonds.

The rates on these securities are well below the rate of inflation, so the government is getting a good deal by issuing them. One reason for the CBN to hold T-bill rates low is to manage –downwards – the cost of the government servicing its own debt.

So, we may be set for reasonably high OMO rates this year (albeit below the rate of inflation) but moderate T-bill rates (starting with an auction in January that settled at 17.75%). Since T-bill rates influence FGN bond rates, we may be set for moderate FGN bond rates this year, too.

In this environment we expect savers in Naira to go looking for extra yield. This can include specialist funds (like infrastructure funds), credit portfolios and equities, among other products.

Most of these involve a degree of risk, so risk management is key. While we expect the authorities to make progress in the battle against inflation this year (with our year-end forecast at 23.5% year-on-year) we also expect savers to behave much as they have done over the past few years, looking for yield enhancement over Treasury Bills.-With Coronation Research.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com