…The Mutual Fund industry grew by 10.1% during the seven months to the end of July 2023 adding a total of N152.8 billion of assets under management

…Data from Nigeria’s Securities and Exchange Commission (SEC) show that Money Market funds were the driving force.

TUE, AUGUST 22 2023-theGBJournal |For most of this year market interest rates have been unappealing, and, in any case, savers have been under pressure from rising inflation. Under these circumstances, one would expect Nigeria’s Mutual Fund industry to have declined. Right?

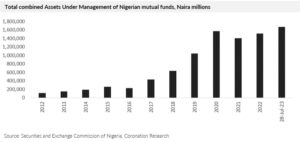

Wrong. The Mutual Fund industry grew by 10.1% during the seven months to the end of July 2023 adding a total of N152.8 billion of assets under management (AUM). This compares with growth of just 8.1% for the full-year 2022 and a decline of 10.6% in 2021. Even though growth of 10.1% over seven months does not beat the rate of inflation, it is a remarkable performance against the odds

Data from Nigeria’s Securities and Exchange Commission (SEC) show that Money Market funds were the driving force.

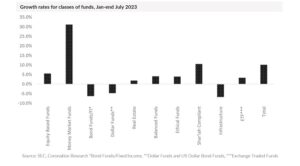

They grew by 30.1% during the seven months to July, adding N191.4 billion of assets under management.

Of 29 SEC registered Money Market funds, 27 grew during the first seven months of this year, 12 of them growing by more than 20%. Growth of assets under management easily outstripped the rate of inflation.

The only other class of fund to record significant growth were Shariah Compliant funds which grew by 10.5% during the first seven months of the year.

What explains the growth of Money Market funds? One reason is the very low yields offered on bank deposits early in the year.

The banknote withdrawal policy meant that banknotes flooded into the accounts of banks in January, making them extremely liquid. Liquid banks do not need to offer their depositors much in the way of interest rates.

Even though Nigerian Treasury Bill (T-bill) rates were low at the time, they were attractive relative to what banks were offering. So Money Market mutual funds, which have large holdings of T-bills, offered much better rates than bank deposits.

And what of the future? Banks are becoming more liquid, thanks to ongoing reforms that remove some of the restrictions imposed on them over the past four years.

And market interest rates appear to be moving upwards. We know that Money Market funds compete with banks for deposits, so the bigger the difference between banks’ deposit rates and market interest rates the better for Money Market funds.

And Money Market funds account for just over half the total assets under management of the industry. The prospects for the industry are improving.-With Coronation Research

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com