WED, SEPT 06 2023-theGBJournal |On July 31, 2023, following deliberations by their respective boards, Dangote Sugar Refinery Plc (DANGSUGAR), NASCON Allied Industries Plc (NASCON) and Dangote Rice Limited (DRL) announced the proposed merger of the entities to form one enlarged company, with DANGSUGAR becoming the surviving entity.

Whilst the merger is still subject to requisite approvals, in a disclosure released last week, DANGSUGAR outlined the scheme consideration for shareholders of NASCON and DRL. In this report, we analyse the merger and outline our thoughts on the possible outcome of the move for the company and shareholders.

The Scheme of Arrangement

According to the released document, each shareholder of NASCON will receive eleven (11) fully paid-up shares of N0.50 each in DANGSUGAR for every twelve (12) NASCON shares of the same value, totalling 2,428,651,847 new ordinary shares of DANGSUGAR.

Likewise, for every one (1) ordinary shares of NGN1.00 each in DRL, each shareholder of DRL will receive fourteen (14) fully paid-up shares of NGN0.50 each in DANGSUGAR, totalling 2,775,792,508 new ordinary shares of DANGSUGAR. In simpler terms, 10,000 shares of NASCON will become 9,167 shares of DANGSUGAR following the 12-for-11 conversion ratio.

In the same vein, 10,000 shares of DRL become 140,000 shares of DANGSUGAR following the 14-for-1 conversion ratio. Since the announcement of the merger in July, the share prices of both DANGSUGAR (+141.4% | YTD: +375.2%) and NASCON (+117.5% | YTD: +491.1%) have accelerated quite significantly, highlighting how keen investors are on the outcome of the merger.

The Enlarged Entity Likely to be Listed at a Premium

The foregoing breeds conversations of share dilution, particularly for DANGSUGAR shareholders. Following the additional shares of 5.20 billion shares to accommodate the shareholders of NASCON and DRL, shares in the new entity will amount to 17.35 billion.

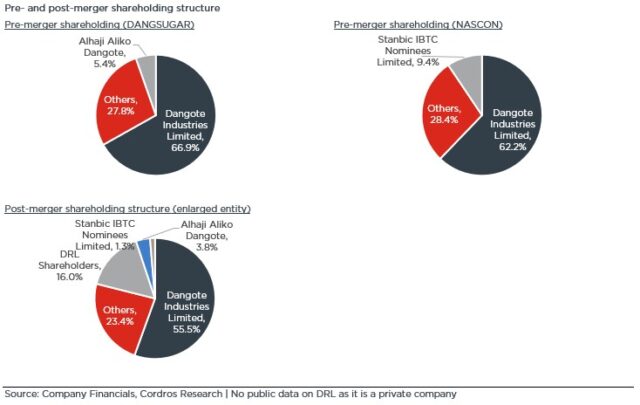

Accordingly, we estimate a 30.0% potential dilution from the merger. Post merger, Dangote Industries Limited, Stanbic IBTC Nominees Limited and other NASCON shareholders will own 55.5% (inclusive of existing shares in DANGSUGAR), 1.3% and 4.0%, respectively.

While dilution is a concern, we highlight that the scheme currently favours DANGSUGAR shareholders than NASCON shareholders. For context, as the 12-for-11 conversion ratio for NASCON shareholders translates to a lower piece of the combined entity, 10,000 NASCON shares previously valued at N610,000.00 now becomes N641,667 worth of shares (9,167 new DANGSUGAR shares) of the new entity, at current market price, whereas DANGSUGAR shareholders have a market value of NGN700,000 of the new entity.

Thus, we believe the eventual listing price will be a key factor to consider to adequately compensate current shareholders of both DANGSUGAR and NASCON while maintaining a level of attractiveness for new investors. To our minds, the new entity will have to be listed at a premium to current market valuation to effect the preceding.

Our analysis of the combined entity post-merger points to an eventual listing price of N87.00/share, which translates to a 126.1% and 24.3% premium on our last DANGSUGAR target price (N38.26/share) and current market price (NGN70.00/share).

Our estimate was derived from a thorough analysis of the new entity, accounting for the potential synergies from the combination of the three businesses and compensation for existing shareholders. We utilized a blend of DCF and relative valuation estimates (EV/EBITDA and P/E) in determining our expected market price.

Our expected listing price points to an average premium of 28.0% for both DANGSUGAR (24.0%) and NASCON (31.0%) shareholders. Upon listing, we expect the new entity formed to line up firmly with the biggest companies by market capitalisation on the domestic bourse.

Is the merger accretive?

Individually, we like the two major entities in the merger. DANGSUGAR’s solid market share, strong distribution network, the potential from its backward integration programme and the growing sugar consumption bodes well for the long term.

For NASCON, despite the stiff competition in the salt and seasonings market amid the pressure in the operating environment, the company has remained resilient, with most of the support stemming from the edible salt segment (82.0% market share).

Overall, we believe the merger is accretive, with our model pointing to a 27.4% EPS accretion in the first year (2024E) of full operations and an average accretion of 22.4% through to 2027E. The aforementioned is driven by our analysis of potential synergies derived from the business combination.

We believe the storage and distribution capabilities of both companies will be the key drivers of growth for the combined entity. DANGSUGAR’s presence in the Southern market will be quite supportive of the growth of NASCON’s salt and seasonings business segments, providing an avenue for increased sales and the solidification of the food market share in the Northern region.

Also, we cite that the leverage that the group provides will be key in combating the stiff competition in the salt market. Our model points to an additional revenue of 15.0% from the aforementioned business segments, with the sugar business contributing the bulk of total revenue.

In terms of costs, we believe the expansion of distribution channels and economies of scale from large-scale production will help to enhance operational leverage and bring down the per-unit cost of production.

We believe that additional savings may also be derived from the elimination of the individual sourcing of the raw material for the combined entity.

However, we acknowledge the risk that the volatility in the global commodity market coupled with the existential FX inadequacies may impact these cost savings.-Analysis is provided by Cordros Research.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com