MON 21 FEB, 2022-theGBJournal- The Centre for the Promotion of Private Enterprise (CPPE), the economic and business advocacy think tank offered an assessment of the recent report on Nigeria GDP Growth, calling for a different approach to measuring the performance of the economy.

‘’Laudable growth performance is one thing,’’ the Centre said, ‘’but translating the growth to improved welfare, job creation, poverty reduction and economic inclusion is a completely different matter.’’

The CPPE noted that the last few years was characterized by worsening poverty situation, high inflationary pressures, massive erosion of purchasing power, high energy prices, escalating production cost, sharp currency depreciation and many more.

‘’These are critical developmental metrics on the basis of which the performance of the economy should also be measured. Therefore, going forward, policy makers should prioritize these key development indicators. Citizens welfare and investment productivity in the economy matter even more than the GDP numbers,’’ CPPE argued.

According to the National Bureau of Statistics [NBS], Nigeria’s GDP grew by 3.40% in 2021, year on year. This marks the highest GDP growth rate since 2015. This growth performance is higher than projections by the IMF (2.6%) and the World Bank (2.7%). The quarterly GDP figures indicates that the economy grew by 3.98% in the fourth quarter of 2021. This was also the fifth consecutive quarterly GDP growth recorded in the economy.

The sectoral disaggregation of the annual GDP data indicates that the following sectors and subsectors recorded positive growth: the rail transport (36.95%), air transport (19.70%), road transport (17.13%), financial institution (10.53%), insurance (6.24%), Trade (8.62%), cement production (6.64%), chemical and pharmaceuticals (8.13%), food and beverage (5.73%), motor vehicles and assembly (4.23%), construction (3.09%), ICT (7.28%), real estate (2.26%).

‘’These growth performances were a reflection of the progressive recovery from the shocks of the pandemic and the rebound of economic activities in these sectors,’’ CPPE said.

‘’However, some sectors contracted. These include oil refining which contracted (47.94%), crude oil production (8.3%), textiles and apparels (1.27%), wood and wood products (1.54%), pulp and paper industry (0.32%), accommodation and food services (0.45%).

It is instructive that the biggest contraction was in the oil and gas sector. These figures are indicative of the weak sectoral performance on account of the collapse of domestic petroleum refineries, crude oil theft, inappropriate policy environment, stifling regulatory environment and dwindling investors confidence.’’

SECTORAL ANALYSIS OF THE GDP

SECTORS THAT RECORDED POSITIVE GROWTH

Agricultural Sector [2.13%]

-Agricultural sector expanded by 2.13%. Though positive, growth in the sector remained subdued by the intractable insecurity in many parts of the country, especially in farming communities. This phenomenon continues to inhibit agricultural productivity.

-Technology application in agriculture remains weak and impacting productivity. Traditional farming methods are still largely dominant. Transportation and logistics continues to aggravate output cost in the sector. The various intervention funds have had a measured impact on productivity because of security and structural factors.

Food and Beverage Manufacturing Sub-sector [5.73%]

-This segment of the manufacturing sector is one of the most resilient.

-The sector is driven by a strong backward integration business model. A significant part of the raw materials is sourced domestically.

-The sector leverages the large domestic market and population.

Cement sub-sector [6.64%].

-Sector characterised by strong backward integration strategy with its main raw materials being sourced locally which is limestone. The sector also leverages a large domestic market and favourable tariff protection.

-Industry structure is oligopolistic

-Impacted by recovery of the real estate and construction sectors.

Chemicals and Pharmaceuticals sub-sector [8.13%]

-Sector benefited from a robust stimulus at the onset of the pandemic.

-Sector leveraged the country’s large population and domestic market.

-There is favourable tariff protection for most of the products in the sector.

-However, sector growth was subdued by the challenges of forex liquidity issues and currency depreciation.

Vehicle Assembly Plants 2.3%

-This sector grew on the back of fiscal policy measures of government. There are generous tariff concessions of SKD and CKD.

-There is a strong lobby to promote the patronage of locally assembled vehicles.

-Sector also grapples with challenges of access to forex and the exchange rate depreciation because of its high import dependence.

Trade Sector [8%]

-It is one of the biggest sectors in the economy contributing 16% to the GDP.

-large employer of labour next only to agriculture.

-The sectors growth was driven by the easing of the pandemic induced. The restoration of global supply chain which was earlier disrupted by the pandemic.

-The resilience of the informal sector also played a role in the growth as the sector is largely driven by the informal sector.

-The sector is also supported by the large market and growing population.

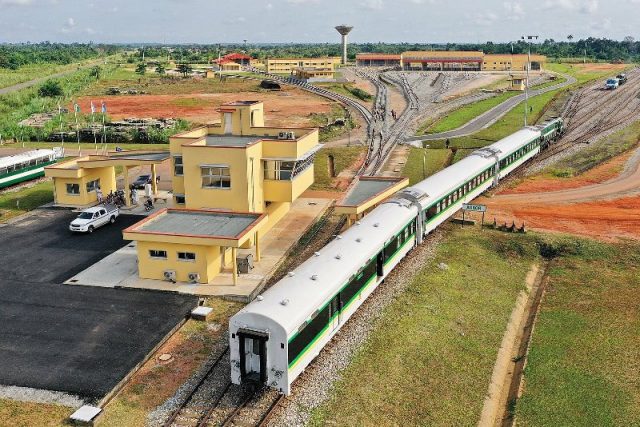

Rail Transport and Pipelines [36.95%]

-This sector recorded one of the highest growths which was 36.95%.

-High patronage of the functioning component of the rail system, especially between Abuja-Kaduna and Lagos-Ibadan. Owing to concerns about insecurity and kidnapping on the road.

-Impact is limited because only a small part of the country is currently covered

-However, the pipeline component of this sub-sector has not made any significant contribution because of the issues of the vandalization of pipelines.

-Rail sector contribution to GDP not captured in the GDP data, perhaps a reflection of its weak contribution to GDP

Air Transport [19.7%]

-This is one of the sectors that experienced the worst shocks inflicted by the pandemic, but now recording one of the fastest recovery.

-The sector benefitted from the easing of lockdown and the easing of travel restrictions domestically and globally.

-Passenger traffic increased because of safety concerns in road transportation.

-Although, the sector remains pressured by high cost of aviation fuel and stifling regulatory compliance costs.

-Sector contributes 0.09% to GDP

Road Transport [17.13%]

-Road transportation is the dominant mode of transportation.

-Easing of the pandemic travel restrictions aided its recovery.

-Improvement in road infrastructure enhanced domestic connectivity.

Maritime Sector

Maritime sector not properly captured in the GDP data

ICT Sector [7.28%]

-The sector is one of the fastest growing as digital technology gains increasing traction.

-The sector’s growth was consistent, even during the pandemic.

-Growth driven partly by the young demographics, youth population of about 60% in Nigeria.

-Many sectors leveraging ICT for growth.

Financial Institutions [10.53%]

-Recovery of economic activities naturally reflect in the performance of financial institutions as financial institutions are central to many transactions in the economy.

-Restoration of economic activities increases banking transactions and also the demand for credit.

-Increasing fiscal deficit and associated government borrowing increases investment opportunities in government securities especially treasury bills and government bonds by financial institutions and their customers.

-Increasing digitization of the sector.

Insurance Sector [6.24%]

-Economic growth recovery naturally reflects in increased insurance transactions.

-Although the impact on the growth of insurance is still subdued because of the weak insurance penetration.

-Sector growth also softened by weak compliance with insurance regulations and laws, especially with regards to insurance of public assets by MDAs.

The Losers

Crude Oil [8.30%]

-Intractable oil theft and vandalization of pipelines.

-Divestment by oil majors from the upstream oil sector,

-lack of political will on the implementation of the Petroleum Industry Act, which weakened investors’ confidence,

-Rapidly evolving global energy transition, making it difficult for fossil fuel investments to attract funding.

-Stifling regulatory environment.

Oil Refining [47.94%]

-This is the sector with the biggest contraction in 2021

-Sector characterized by unfriendly policy environment,

-Perpetuation of petroleum subsidy and the associated distortions and transparency challenges

-It is difficult to attract private investment because of subsidy induced distortions.

-The dominance of the sector by the public sector namely the NNPC.

Textile and Apparel [1.27%]

-The dominance of textile market by second-hand clothes largely as a result of poverty.

-Smuggling of textile materials, fabrics and second-hand clothing

-High cost of domestic production of textiles, especially the high energy cost.

-High prices of locally produced textiles.

-Obsolete technology of many textile manufacturing firms, affecting productivity, cost and competitiveness.

Wood and Wood Product [1.54%]

This sector contracted by 1.54% as a result of the following:

-Illegal exports of woods

-High cost of furniture production

-Weak aggregate demand

-Intense competition in the sector because of the ease of entry and exit

Pulp and Paper Industry [0.32%]

-Collapse of the paper mills [Nigeria Newsprint Manufacturing Company, Oku Iboku; National paper Manufacturing Company, Iwopin; Nigeria Paper Mill, Jebba

-Total dependence on imported raw materials

-Foreign exchange issues around liquidity and depreciation in the currency

-Disruption caused by the digital revolution which negatively impact the paper and printing industry.

-Many transactions are done online which require, this reduces the demand for paper.

Accommodation and Food Services [0.3%]

-The hospitality industry is yet to fully recover from the shocks of the pandemic.

-High operating cost in the hospitality industry, especially energy cost.

-Intense competition in the sector, eroding profit margins,

-Weak consumer demand.

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email: govandbusinessj@gmail.com|