International energy companies in Nigeria have agreed to provide about $200 million to help fund fuel imports amid a foreign-currency shortage, Petroleum Minister of State Emmanuel Kachikwu said.

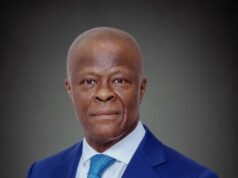

“I have been able to convince the upstream oil companies to provide foreign exchange buffers over the next one year for those who’re bringing in products,” Kachikwu said in video posted on his Facebook page on Thursday.

Total SA and Exxon Mobil Corp. will provide dollars to their local retails units, Total Nigeria Plc and Mobil Oil Nigeria Plc, while Royal Dutch Shell Plc has been paired with local oil importer Conoil Plc and Eni SpA with Oando Plc, said Kachikwu.

Companies importing fuel in Nigeria have been hindered by lack of access to foreign exchange following the plunge in the price of oil, the main foreign income earner in Africa’s largest oil exporter.

This has resulted in widespread supply shortages across the country of about 180 million people that state-owned Nigerian National Petroleum Corp., or NNPC, has been unable to address, Kachikwu said.

Nigeria imports about 70 percent of its refined-fuel needs, after decades of poor maintenance and mismanagement left four state-owned refineries working at a fraction of their 445,000 barrels per day capacity.

Royal Dutch Shell, Total, Eni, Chevron Corp. and Exxon Mobil Corp. run joint ventures with the NNPC that pump about 80 percent of Nigeria’s crude.

Shell officials in Lagos declined to comment, while spokespeople at Chevron, Exxon, Total and Eni didn’t immediately respond to requests for comment.

Getting the upstream companies to intervene and matching them to downstream business lines for the provision of foreign exchange is an “ingenious move,” said Oyeyemi Oke, senior associate of energy and projects at Lagos-based law firm Templars.

“Although a short-term strategy, it would mitigate the current challenges faced by major marketers with regards to access to foreign exchange,” he said. “That said, a long-term solution to ensure availability of petroleum products should be put in place,” including ensuring existing refineries are operating at full capacity and new facilities are built, and liberalizing access to foreign exchange, he said.

With the backing of President Muhammadu Buhari, the central bank has pegged the naira at 197 to 199 a dollar since last year through capital controls and import restrictions.

The oil ministry has been in talks with the central back to make a special foreign-currency allocation for fuel importers, Kachikwu said.

“I’ve had to box my way through the Central Bank of Nigeria to get a little bit more allocation because we provide the bulk of this foreign exchange; we should have a bit of it to help stabilize the fuel situation,” he said.

Bloomberg