…The sum of N80.993 billion was given for the cost of collection, while N878.946 billion was allocated for Transfers Intervention and Refunds.

…he Gross Statutory Revenue of N1.043 trillion received for the month was lower than the sum of N1.221 trillion received in the previous month by N177.426 billion.

…Oil and Royalty, Excise Duty, Electronic Money Transfer (EMTL) and CET levies increased considerably.

FRI OCT 18 2024-theGBJournal| The Federation Account Allocation Committee (FAAC), shared a total sum of N1.298 trillion to the three tiers of government as Federation Allocation for the month of September, 2024 from a gross total of N2.298 trillion.

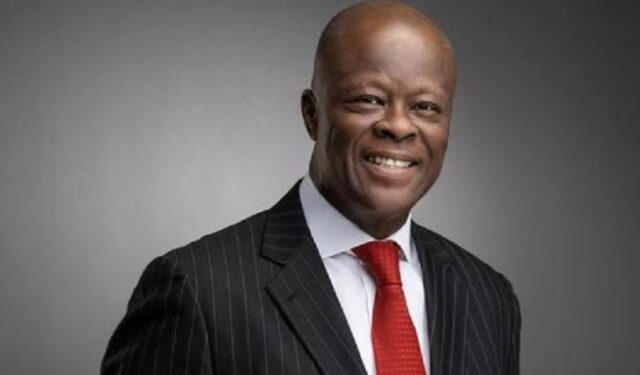

The allocation decision was taken at FAAC October 2024 meeting chaired by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

From the stated amount inclusive of Gross Statutory Revenue, Value Added Tax (VAT), Electronic Money Transfer Levy (EMTL), Exchange Difference (ED and Augmentation of N150.000 billion, the Federal Government received N424.867 billion, the States received N453.724 billion, the Local Government Councils got N329.864Billion, while the Oil Producing States received N90.415 billion as Derivation, (13% of Mineral Revenue).

The sum of N80.993 billion was given for the cost of collection, while N878.946 billion was allocated for Transfers Intervention and Refunds.

The Communique issued by the Federation Account Allocation Committee (FAAC) at the end of the meeting indicated that the Gross Revenue available from the Value Added Tax (VAT) for the month of September 2024, was N583.675 Billion as against N573.341 Billion distributed in the preceding month, resulting in a increase.

From that amount, the sum of N23.347 Billion was allocated for the cost of collection and the sum of N16.810 Billion given for Transfers, Intervention and Refunds.

The remaining sum of N543.518 Billion was distributed to the three tiers of government, of which the Federal Government got N81.258 billion, the States received N271.759 Billion and Local Government Councils got N190.231 billion.

Accordingly, the Gross Statutory Revenue of N1.043 trillion received for the month was lower than the sum of N1.221 trillion received in the previous month by N177.426 billion.

From the stated amount, the sum of N56.878 billion was allocated for the cost of collection and a total sum of N862.136 Billion for Transfers, Intervention and Refunds.

The remaining balance of N124.718 billion was distributed as follows to the three tiers of government: Federal Government got the sum of N43.037 billion, States received N21.829 Billion, the sum of N16.829 billion was allocated to LGCs and N43.021 billion was given to Derivation Revenue (13% Mineral producing States).

Also, the sum of N19.213 billion from Electronic Money Transfer Levy (EMTL) was distributed to the three tiers of government as follows: the Federal Government received N2.767 billion, States got N9.222 billion, Local Government Councils received N6.456 billion, while N0.768 billion was allocated for Cost of Collection.

The Communique also disclosed the sum of N462.191 billion from Exchange Difference, which was shared as follows: Federal Government received N218.515 Billion, States got N110.834 billion, the sum of N85.448 billion was allocated to Local Government Councils, N47.394 billion was given for Derivation (13% of Mineral Revenue).

It further disclosed of the Augmentation of N150.000 billion which was shared as follows: Federal Government received N70.020 Billion, the States got N40.080 billion and the LGCs received N30.900 billion.

Oil and Royalty, Excise Duty, Electronic Money Transfer (EMTL) and CET levies increased considerably.

While Value Added Tax (VAT) and Import Duty increased marginally. Petroleum Profit Tax (PPT) and Company Income Tax (CIT) and others recorded significant decreases.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com