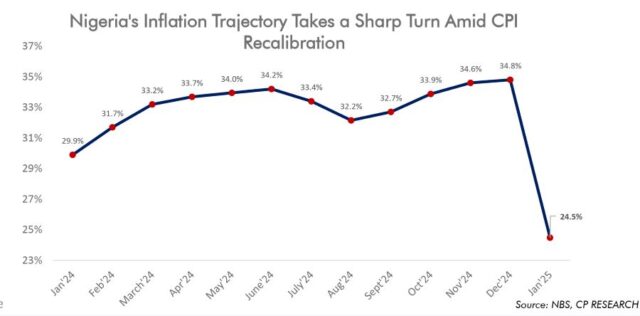

…The newly adjusted Headline CPI for January 2025 stands at 24.48% year-over-year, marking a dramatic 10.3% decline from the previous month’s figures.

WED FEB 19 2025-theGBJournal| In a transformative recalibration that could redefine Nigeria’s economic trajectory, inflation metrics have been reshaped by rebasing the Consumer Price Index (CPI), unveiling a striking shift in expectations.

The newly adjusted Headline CPI for January 2025 stands at 24.48% year-over-year, marking a dramatic 10.3% decline from the previous month’s figures.

Technically, on a month-to-month scale, inflation accelerated by 10.68% in January 2025 (index of 110.68) compared to the new base period, December 2024 (index of 100.00).

While the headline figure’s adjustment signals a step toward stability, the latest figure still represents a 2.66% rise from the 21.82% initially recorded in January 2024, narrowing the inflationary gap.

With Nigeria now aligning more closely with Comercio’s 2025 Outlook projection—

anticipating inflation to ease to 15%-20% by mid-year—this recalibration could mark a decisive turning point in the country’s battle against economic volatility.

The tide is shifting, and a new chapter in Nigeria’s inflation narrative is unfolding.

A Statistical Illusion? Nigeria’s Inflation Decline Is a Recalibration, Not a Resolution

The recent rebasing of Nigeria’s Consumer Price Index (CPI) marks a pivotal evolution in the nation’s inflation measurement, replacing the 2009 base year with 2024 and expanding the consumption basket from 740 to 934 items.

The newly reported headline inflation figures show a significant decline compared to previous reports, but this difference should not drive excessive optimism. The more relevant gauge of inflationary pressure moving forward will be month-on-month (MoM) changes, which better capture short-term price movements and cost dynamics.

The January MoM inflation rate stood at 10.68%, as the CPI index for January was 110.68, compared to 100.00 in December.

The sharp rise from December’s 2.44% MoM increase should not be a source of concern, as this surge is also a product of the statistical recalibration. MoM changes from February onward will provide a more meaningful gauge of inflation trends.

By aligning inflation tracking with recent economic conditions, the updated methodology helps bridge the gap between reference and measurement periods, offering a more accurate reflection of consumer spending patterns and price movement assessments.

One of the most significant implications of this recalibration lies in its effect on short-term price volatility. By modernizing the reference period, the new methodology compresses the time horizon for inflation comparisons, smoothing out transient price fluctuations.

Moreover, adjustments to the composition and weighting of the food basket—long a dominant force in Nigeria’s inflation trends—introduce further stabilization. With food and energy prices now carrying a reduced weight in calculation, their influence on inflation metrics is moderated.

While this revision tempers volatility in the year-over-year (YoY) inflation readings, MoM changes will serve as a more precise indicator of ongoing cost pressures.

By anchoring inflation measurements to 2024, a year that recorded some of the highest inflation levels in three decades, the rebase is expected to exert downward pressure on reported inflation figures.

However, this recalibration does not necessarily signal a fundamental easing of price dynamics; rather, it represents a statistical shift that may contribute to a more tempered inflation outlook.

The reduced emphasis on food and energy costs, historically major inflation drivers, could further reinforce this moderation in reported figures.

The timing of this recalibration is strategically aligned with broader policy objectives. In his New Year address, the president reaffirmed his administration’s commitment to bringing inflation down to 15%.

The rebased CPI may offer statistical support for this target, potentially painting a more favorable inflation trajectory.

However, the true test lies beyond the numbers—whether this statistical refinement translates into tangible economic relief will depend on the effectiveness of fiscal and monetary policies in addressing the underlying structural cost pressures that continue to drive inflation.

The Monetary Policy Committee (MPC) Conundrum: Less Hawkish vs Dovish?

The recent rebasing of Nigeria’s Consumer Price Index (CPI) has redefined the nation’s inflationary landscape, setting the stage for a pivotal Monetary Policy Committee (MPC) meeting on February 19–20, 2025.5.

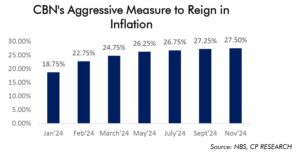

Throughout 2024, the Central Bank of Nigeria (CBN) pursued an aggressive tightening strategy, holding the Monetary Policy Rate (MPR) at elevated levels to counter persistent inflationary pressures. However, with recalibrated inflation figures now in play, the dynamics of monetary policy deliberations could take an unexpected turn.

As policymakers convene, the MPC may lean toward a dovish stance, particularly if they interpret the inflation drop as a fundamental shift in price stability rather than a mere technical recalibration.

In this scenario, the committee could opt to hold rates steady at its first meeting, waiting for further confirmation of sustained disinflation before altering its policy trajectory.

If subsequent data continues to reflect moderate inflation prints, the groundwork may be laid for a gradual policy pivot, signalling a departure from the hawkish stance that defined 2024.

The upcoming MPC meeting scheduled for February 19-20, 2025, will be closely watched, as it could mark a critical inflection point in Nigeria’s monetary policy, shaping the course of inflation management and economic growth in the months ahead.

The Bond Market Buzz: Riding the Yield Curve Rollercoaster

In the bond market, these developments signal a crucial moment for investors to reassess inflation expectations and adjust risk models.

The decline in inflation could compress near-term risk premiums, potentially encouraging a shift toward long positions if investors anticipate future rate cuts.

If inflation expectations remain well anchored, existing bonds could close the year in positive territory. With inflation easing on a month-on-month basis, CBN may soon have room to adopt a more dovish stance.

Despite this expected shift, we remain confident that inflationary pressures will decline significantly this year, aligning with our 2025 outlook projections.

Additionally, we anticipate that CBN will loosen credit conditions very soon,

providing further support for economic activity and financial markets.

Ubah Jeremiah Ifeanyi, Olamide Ologunagbe, Farouk Akande, Toluwalase Onipede, Uduak Jacob, Opeyemi Babalola, Olufunso Olalekan, and Taiwo Onabajo. Comercio Partners Macroeconomic Outlook 2025-Comercio Partners Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com