SAT, JULY 15 2023-theGBJournal |The NGX All-Share Index and Market Capitalization depreciated by 0.75% to close the week at 62,569.73 and N34.070 trillion respectively, despite the market’s strong start to week and positive reactions to DANGCEM’s share buy-back announcement.

Similarly, all other indices finished lower with the exception of NGX Oil and Gas, NGX Lotus ll and NGX Industrial Goods Indices which appreciated by 1.43%, 0.72% and 9.01% respectively while the NGX ASeM and NGX Sovereign Bond Indices closed flat.

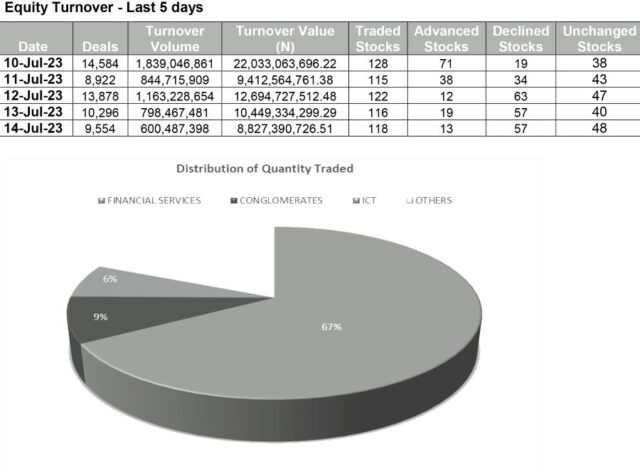

Trading in the top three equities namely United Bank for Africa, Transnational Corporation Plc and FBN Holding Plc (measured by volume) accounted for 1.222 billion shares worth N15.523 billion in 8,260 deals, contributing 23.28% and 24.48% to the total equity turnover volume and value respectively.

Based the preceding, the Month-to-Date and Year-to-Date returns printed +2.6% and 22.1%, respectively.

Likewise, activity levels were weak, as trading volume and value declined by 46.6% w/w and 56.4% w/w, respectively.

By sectors, the Banking (-14.3%), Insurance (-11.5%), and Consumer Goods (-2.3%) declined, while the Industrial Goods (+9.0%) and Oil and Gas (+1.4%) indices closed in the green.

With the half-year earnings season on the horizon, we believe investors will look for clues on the sustainability of the decent corporate earnings released for Q1-23.

However, we expect mixed market performance in the week ahead as bargain hunting on dividend-paying stocks will be matched by intermittent profit-taking activities.

Meanwhile, global stocks rallied sharply this week as investors unwound bets on more aggressive rate hikes after softer-than-expected US inflation data.

In line with this, US equities (DJIA: +2.0%; S&P 500: +2.5%) are on course for a weekly gain as investors cheered the prospects of the central bank taming inflation without tipping the economy into a recession.

Likewise, positive sentiments supported European equities (STOXX Europe: +3.1%; FTSE 100: +2.5%) as investors welcomed the easing inflation momentum.

Asian markets posted broadly bullish performances, with the Nikkei 225 (+0.2%) and SSE (+1.4%) posting gains as hopes of a Beijing stimulus package fueled a rally in tech stocks.

Finally, the Emerging (MSCI EM: +4.1%) and Frontier (MSCI FM: +2.1%) market indices closed on a bullish note driven by gains in China (+1.4%) and Vietnam (+2.7%), respectively.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com