…New Forum research examines how policymakers can use economic statecraft measures to protect national security and sovereignty without reducing global prosperity.

THUR JAN 23 2025-theGBJournal| A new World Economic Forum report released today reveals significant economic risks from increasing geoeconomic fragmentation.

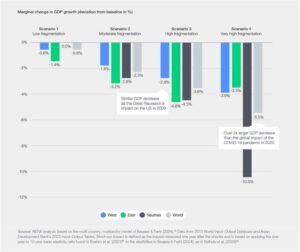

The Navigating Global Financial System Fragmentation report estimates that fragmentation resulting from statecraft policies could cost the global economy $0.6 trillion to $5.7 trillion – up to 5% of global GDP – due to reduced trade and cross-border capital flows as well as lost economic efficiencies. It could also increase global inflation by more than 5% in a very high fragmentation scenario.

The report, developed in collaboration with Oliver Wyman, shows that the economic impact of rising geoeconomic fragmentation could surpass the disruptions caused by the 2008 financial crisis or the COVID-19 pandemic.

As countries increasingly use the financial system to advance their geopolitical objectives – evidenced by a 370% rise in sanctions since 2017, along with subsidies, industrial policies and discussions about the creation of parallel financial architectures – the report calls on policy-makers to adopt economic statecraft that fosters cooperation, sustainable development and resilience in the global economy.

“The potential costs of fragmentation on the global economy are staggering,” says Matthew Blake, Head of the World Economic Forum’s Centre for Financial and Monetary Systems. “Leaders face a critical opportunity to safeguard the global financial system through principled approaches.”

Fragmentation impact

The impact of fragmentation on inflation rates and GDP growth depends heavily on the policies adopted by global leaders. With a principled approach, policymakers can advance appropriate policies for their economies and societies while mitigating unintended effects on areas like cost of living and GDP growth.

For example, modelling trade relationships shows that GDP growth could decrease nearly 10 times more in a scenario involving a full decoupling of Eastern (i.e., China and Russia) and Western (i.e., the US and its allies) blocs compared to a lower fragmentation scenario where capital and trade flows are only restricted in sensitive areas related to national security and competitiveness. Similarly, inflation would be nearly nine times higher in this same comparison.

In the most extreme fragmentation scenario, a full economic decoupling between Eastern and Western blocs would force unaligned countries to trade exclusively with their most significant economic partner. These nations could see GDP growth drop by over 10% – nearly double the global average – with India, Brazil, Türkiye, and emerging economies in Latin America, Africa and South-East Asia bearing the greatest burden.

“Fragmentation not only fuels inflation, but also negatively impacts economic growth prospects, particularly in emerging markets and developing economies that depend on an integrated financial system for their continued development,” says Matt Strahan, Private Markets Lead, World Economic Forum.

“By protecting the integrity and functionality of the global financial system, including through ensuring that actors maintain their right to engage with counterparts across the geopolitical spectrum, leaders can deliver a more effective financial system for all stakeholders.”

Protecting the global financial system

The report presents the Principles to Safeguard the Global Financial System from Fragmentation, developed by over 25 financial sector CEOs, academics, and other leaders.

These principles underpin the effective functioning of financial services globally and their protection stands to help reduce the impacts of fragmentation in the financial system.

The principles outline eight key conditions for maintaining financial system operations and market confidence, including respect for the rule of law, property ownership rights, system interoperability and avoiding unilateral expropriation of sovereign assets.

“Economic statecraft measures such as sanctions, export controls and tariffs are increasingly being used by nations as part of their foreign policy toolkit, making it critical to establish a governing framework to avoid unintended shocks to the global economy,” says Daniel Tannebaum, Partner and Global Leader, Anti-Financial Crime Practice, Oliver Wyman.

“This new report serves as a private sector call to action to ensure that market stability and global prosperity are considered by governments when deploying economic policies.”

Additionally, the report outlines approaches for implementing economic statecraft that protect national security and sovereignty without reducing global prosperity. These include eight key considerations for policymakers, focusing on the design of more effective sanctions, promoting areas of mutual gain, reducing unintended costs, and modernizing the financial system to reflect 21st-century geopolitical and economic dynamics.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com