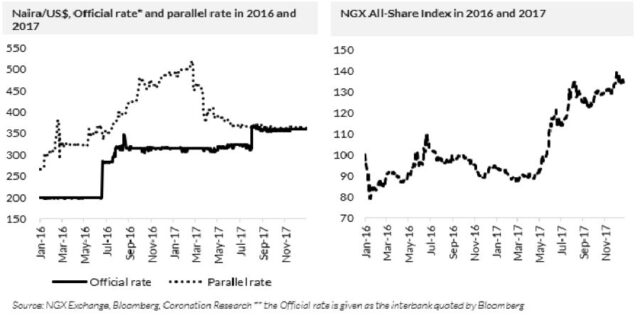

TUE, JUNE 27 2023-theGBJournal |Since the beginning of 2015 investors have witnessed two major realignments of the official Naira/US dollar foreign exchange rate with the parallel rate.

The first happened in mid-2017 when the two rates converged on N360.0/US$1. The second is happening now, although it seems (so far) to be a case of the official rate (which was N471.50/US$1) descending to meet the parallel market rate at around N770.00/US$1, or even slightly lower.

So, what happened in 2017? It was an excellent year for Naira-denominated investors, both fixed-income investors and equity investors.

Inflation declined from 18.7% year-on-year to 15.4% year-on-year, market interest rates fell and FGN bond prices rallied. After the three straight consecutive years of declines in the NGX Al-Share Index the equity market rallied by 42.3%.

Are there any lessons from 2017? We think so. Bank stocks performed well in 2017 and we think that they will perform well again in 2023, given that most of the major listed banks hold net long positions in US dollars and will report translation gains.

We also think there is a chance that bank regulations affecting Naira liquidity will be eased.

There are also many differences with 2017. By mid-2017 the economy was emerging from a five-quarter recession and the appreciation in the parallel exchange rate improved business conditions.

The foreign investor was still a significant factor in the Nigerian equity market in 2017: much less so now, although recent data shows a net inflow of foreign investment into the NGX Exchange.

Perhaps most importantly, the monetary authorities were able to engineer market interest rates (e.g. 1-year

Treasury) above the rate of inflation, something to which investors usually respond positively.

This begs one question about the second half of 2023. Which way are interest rates going to move? A liberalised foreign exchange rate points to elevated interest rates in order to make it worthwhile holding money in Naira.

Fuel subsidy removal, effective 31 May, suggests that cost pressures will push inflation upwards, which also argues for elevated interest rates.

Against this, the All Progressives Congress (APC) manifesto proposed low interest rates to encourage economic growth.

We do not know, at this stage, how the incoming APC administration and the Central Bank of Nigeria will resolve this critical area of policy.

On the bright side, the removal of fuel subsidies and the liberalisation of the Naira foreign exchange rate are historic events, and will themselves straighten out much of the dysfunctional economic behaviour we have become accustomed to.

The Punch newspaper reported a regional Customers Area Controller stating that fuel smuggling had reduced drastically in his zone. These reforms are good for the economy and in the long run are good for markets./ With Coronation Research

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com