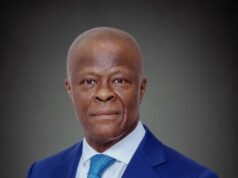

JANUARY 12, 2018 – OPEC may get the credit for the longest winter decline in U.S. crude stockpiles in a decade, but other factors are also at play, including strong refining margins, frigid weather and robust foreign demand.

Here’s the breakdown on U.S. stockpiles, followed by four charts outlining key contributors to rising prices:

A year ago, some analysts were predicting the Organization of the Petroleum Exporting Countries and its allies wouldn’t be disciplined enough to harness production. The cartel and partners such as Russia have largely kept their pledge, helped by supply disruptions in Libya and Venezuela.

In November, the group agreed to keep the cuts in place for all of 2018 and beefed up the agreement by including Nigeria and Libya. Here’s a breakdown:

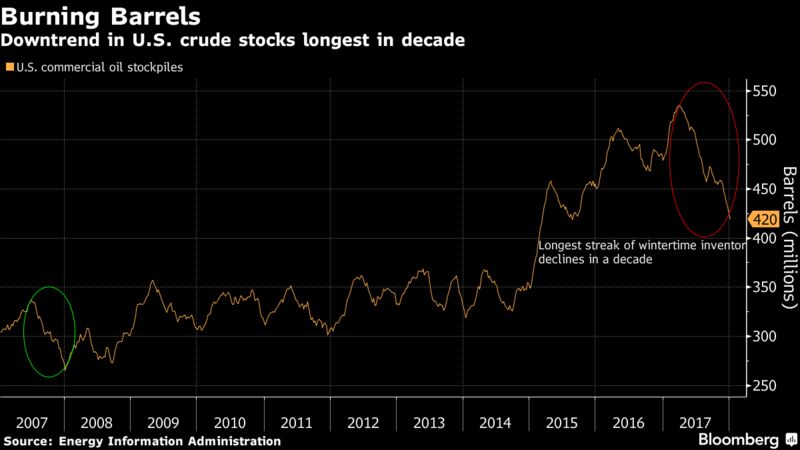

Long-term demand for crude may be threatened by the electric car revolution and governments’ attempts to control climate change, but it’s likely to happen slowly. Exxon Mobil Corp. expects just 6 percent of the global vehicle fleet to be electric by 2040, given robust demand for traditional combustion engines in emerging markets.

On Tuesday, the World Bank lifted its 2018 global economic-growth forecast to 3.1 percent, which, if achieved, will consume a lot of petroleum:

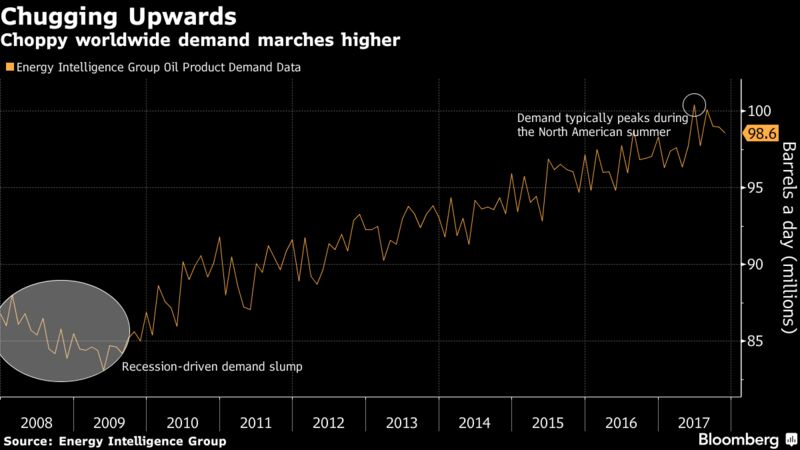

Overseas demand for American oil has blossomed, exceeding 1 million barrels a day almost every week since late September, when ports and terminals along the Texas coast finally recovered from Hurricane Harvey. Many foreign refiners will pay a premium for crude from U.S. shale fields because of its easy-to-handle properties and the high proportion of valuable fuels it tends to yield.

“Most thought that coming into 2018, the commodities trade in general was one that would be successful,” Rob Thummel, managing director at Tortoise Capital Advisors LLC, which handles $16 billion in energy-related assets, said by telephone. “Given the momentum that’s been building for commodities in general and oil in particular, in an economy both domestically and globally that’s got a lot of momentum behind it, oil is benefiting from that.”

The result: Hedge funds raised bets on rising Brent crude to a record, according to the latest ICE Futures Europe data. At the same time, bullish wagers on West Texas Intermediate, the U.S. benchmark, remain near the highest levels in almost a year, U.S. Commodity Futures Trading Commission data shows.