FRI, 18 NOV, 2022-theGBJournal| ‘’The accelerated growth in fiscal deficit financing by the CBN is heightening liquidity in the economy with consequences for soaring inflation,’’ says the Centre for the Promotion of Private Enterprise (CPPE).

The Centre, in a note to theG&BJournal, highlighted the consequences of the mounting inflationary pressures for the economy as weakening of purchasing power of citizens as real incomes are eroded, increasing poverty incidence, escalation of production costs which negatively impacts profitability, erosion of shareholder value in many businesses as well as weakening of investors’ confidence and declines in manufacturing capacity utilization.

It warned that the surging inflation has become a major macroeconomic concern to stakeholders in the Nigerian economy.

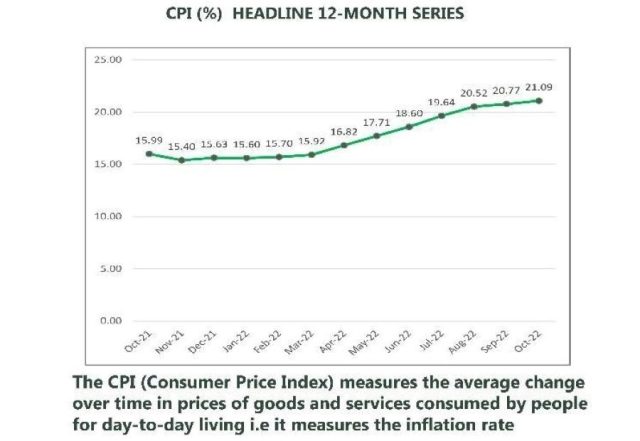

Headline inflation accelerated to 21.09% in October as against 20.77 in September. However, on a month-on-month assessment, there was a decline of 0.11% in the headline inflation. It declined from 1.36% in September to 1.24% in October.

Food inflation maintained its upward trajectory, accelerating to 23.72 with a month on month decline of 0.21%. Core inflation similarly spiraled to 17.76% in October.

‘’Evidently, we are yet to see an abatement to the key factors fueling inflation. Some of these factors are global, others are domestic. They are a combination of structural and policy issues,’’ Dr Muda Yusuf, CEO, CPPE said.

He said, tackling inflation requires urgent government intervention to address the challenges bedeviling the supply side of the economy, addressing production and productivity constraints, fixing the dysfunctional forex policy, and institution of fiscal reforms to curb escalating deficit spending.

These factors include the depreciating exchange rate, rising transportation costs, logistics challenges, forex market illiquidity, hike in diesel cost, climate change, insecurity in many farming communities and structural bottlenecks to production.

According to the CPPE, ‘’these are largely supply side and policy concerns. Monetary policy tightening in most economies around the world, especially the leading economies, is also driving imported inflation and the depreciation in the exchange rate.’’

‘’To give producers and citizens some relief, the government could tweak the tariff policies by granting concessionary import duty on intermediate products for industrialists, especially those in the food processing segments of the agriculture value chain.’’ he suggested.

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com