…82% of chief economists expect the global economy to remain stable or strengthen this year – almost twice as many as in late 2023

…Over two-thirds predict a sustained rebound of global growth, driven by technological transformation, artificial intelligence and the green transition

…There is near-unanimity that geopolitics and domestic politics will drive economic volatility this year

WED MAY 29 2024-theGBJournal| The latest Chief Economists Outlook released today presents a growing sense of cautious optimism about the global economy in 2024.

More than eight in ten chief economists expect the global economy to either strengthen or remain stable this year – nearly double the proportion in the previous report. The share of those predicting a downturn in global conditions declined from 56% in January to 17%.

But geopolitical and domestic political tensions cloud the horizon. Some 97% of respondents anticipate that geopolitics will contribute to global economic volatility this year. A further 83% said domestic politics will be a source of volatility in 2024, a year when nearly half the world’s population is voting.

“The latest Chief Economists Outlook points to welcome but tentative signs of improvement in the global economic climate,” said Saadia Zahidi, Managing Director, World Economic Forum.

“This underscores the increasingly complex landscape that leaders are navigating. There is an urgent need for policy-making that not only looks to revive the engines of the global economy but also seeks to put in place the foundations of more inclusive, sustainable and resilient growth.”

Regional variations

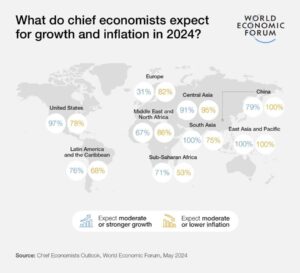

Growth expectations have improved, though unevenly, across the globe. The survey reveals a significant boost in the outlook for the United States, where nearly all chief economists (97%) now expect moderate to strong growth this year, up from 59% in January.

Asian economies also appear robust, with all respondents projecting at least moderate growth in the South Asia and East Asia and Pacific regions. Expectations for China are slightly less optimistic, with three-quarters expecting moderate growth and only 4% predicting strong growth this year.

By contrast, the outlook for Europe remains gloomy, with nearly 70% of economists predicting weak growth for the remainder of 2024. Other regions are expected to experience broadly moderate growth, with a slight improvement since the previous survey.

A challenging landscape for decision-makers

The latest survey highlights the escalating challenges confronting businesses and policy-makers. Tensions between political and economic dynamics will be a growing challenge for decision-makers this year, according to 86% of respondents, while 79% expect heightened complexity to weigh on decision-making.

Among the factors expected to affect corporate decision-making are the overall health of the global economy (cited by 100%), monetary policy (86%), financial markets (86%), labour market conditions (79%), geopolitics (86%) and domestic politics (71%).

Notably, 73% of economists believe that companies’ growth objectives will drive decision-making, almost double the proportion that cited the role of companies’ environmental and social goals (37%).

Long-term prospects and priorities

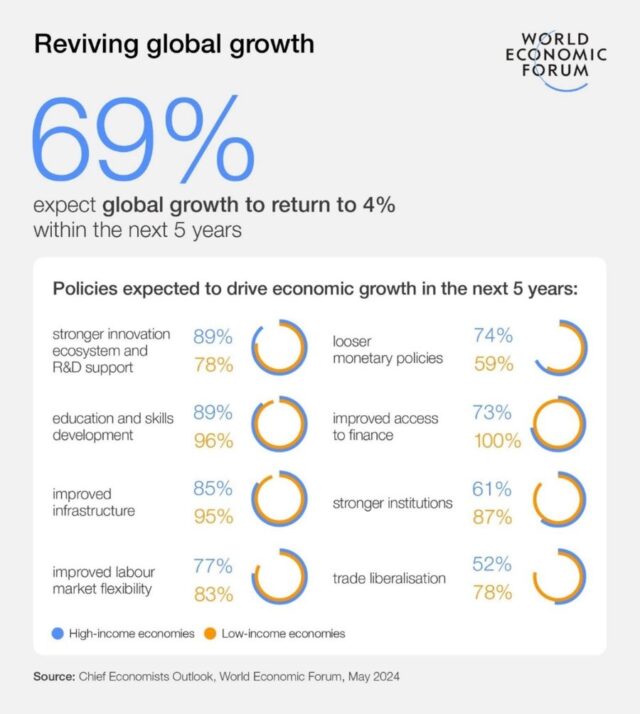

Most chief economists are upbeat about the prospects for a sustained rebound in global growth, with nearly 70% expecting a return to 4% growth in the next five years (42% within three years). In high-income countries, they expect growth to be driven by technological transformation, artificial intelligence, and the green and energy transition.

However, opinions are divided on the impact of these factors in low-income economies. There is greater consensus on the factors that will be a drag on growth, with geopolitics, domestic politics, debt levels, climate change and social polarization expected to dampen growth in both high- and low-income economies.

In terms of the policy levers most likely to foster growth in the next five years, the most important across the board are innovation, infrastructure development, monetary policy, and education and skills. Low-income economies are seen as having more to gain from interventions relating to institutions, social services and access to finance compared to high-income economies. There is a notable lack of consensus on the impact for growth of environmental and industrial policies.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com