TUE. 28 FEB, 2023-theGBJournal| The equity market in 2023 differs from that of 2015. In January, we highlighted in our investment strategy outlook (see: Coronation Research, Better times in 2023, 11 January 2023) that the impending 2023 General Elections could affect the market similarly to how they did in 2015.

Back then, the elections involved high levels of uncertainty as the newly emerging All Progressives Congress (APC) threatened the long-standing Peoples Democratic Party (PDP).

Similarly, with three major parties (APC, PDP, and the Nigeria Labour Party) vying for the presidency in 2023, it’s hard to predict the outcome, and this could drive a risk-off sentiment in the equity market as it did in 2015.

However, this year, the equity market has defied expectations. In 2015, the general elections were originally slated for February 14th, but they were postponed to March 28th due to issues with Permanent Voters Card (PVC) distribution and insurgent activity in various North-Eastern states.

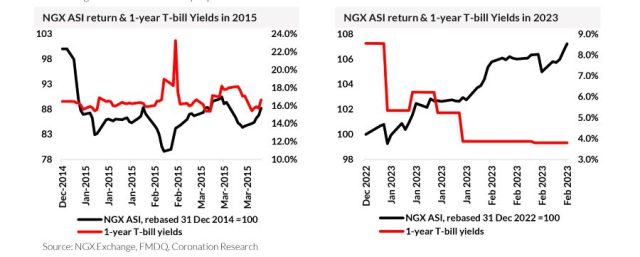

In the run-up to the elections, the equity market declined 11.81% from the beginning of the year to March 28th, 2015. This year, however, the market has gained 7.96% year-to-date. What factors have changed since 2015 that may explain this difference?

We believe that a change in the composition of market participants in the Nigerian equity market is a significant factor in the market’s bullish trend. According to the Domestic and Foreign Portfolio Participation report of the NGX Exchange Group, total transactions on the local stock exchange amounted to N189.72bn (US$958.18m) in January 2015.

Monthly Foreign Portfolio Investment (FPI) transactions declined to N99.11 billion, down by 20.39% from December 2014. Domestic transactions fell from 51.76% in December 2014 to 47.76%, while FPI transactions increased from 48.24% to 52.24% over the same period. As foreign investors drove most of the total transactions on the exchange at the time, the market saw FPI outflows (26.92% of total transactions) outpace inflows (25.32%) in the run-up to the elections. In February 2015, total transactions on the local stock exchange fell by 2.76% to N184.49 billion.

The postponement of the elections further alarmed foreign investors, as monthly FPI transactions rose to N133.95 billion, up by 35.15%, driven by even higher FPI outflows (44.32%) than inflows (28.38%).

Domestic investors were also worried, conceding approximately 45% of trading to foreign investors and causing domestic transactions to decrease from 47.76% in January to 27.39%, while FPI transactions increased from 52.24% to 72.61% over the same period.

Since 2015, the number of foreign investors leaving the Nigerian stock market has been increasing due to several challenges, including the existence of multiple exchange rates that affect credible price discovery, and FX scarcity, which impedes repatriation of funds.

As of January 2023, the total value of transactions in the nation’s stock market rose by 38.66% to N195.10bn (US$422.94m) from N140.70bn in December 2022. Although monthly FPI transactions increased by 63.71% m/m to N24.9bn, with FPI outflows (7.72%) still exceeding inflows (5.04%), the total value of transactions executed by domestic investors outperformed those executed by foreign investors by about 74%.

As a result, the share of domestic investor participation rose to about 87%, while that of foreign investors dropped to about 13%.

The increased percentage participation by domestic investors in the local stock market is due to several factors: firstly, the limited investment opportunities in Nigeria’s money and capital markets; secondly, the expanded system liquidity, making riskfree assets such as treasury bills less attractive (see Coronation Research, ‘Why have savings ratesfallen?’, 13 February 2022); and thirdly, bargain-hunting investors holding positions to qualify for the upcoming FY 2022 dividend season.

Although the reduction in foreign investor participation has short-term benefits in shielding Nigerian markets from global economic downturns that drive capital flight across global markets, the long-term consequences are far-reaching. We do not expect a recovery in foreign participation in our markets until a solution to the issues of multiple exchange rates and FX shortages is found.-Analysis is provided by Coronation Research

Twitter-@theGBJournal| Facebook-the government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com