TUE, JUNE 20 2023-theGBJournal |Airtel Africa’s Nigerian-listed shares have been an enigma.

In 2022 they rose by 71% when the NGX All-Share Index rose by 20% and in 2023, year-to-date, they have declined by 20% while the NGX All-Share Index has risen by 15%.

By contrast, shares in Airtel Africa’s stablemate in the Nigerian telecoms sector, MTN Nigeria, rose by a more reasonable 11% last year and have risen by 25% year-to-date.

Aritel Africa shares have been highly volatile and, several times last year, they traded at a price-to earnings (PE) ratio of more than double that of MTN Nigeria.

What was the attraction in the shares? The answer is foreign exchange. Airtel Africa is listed both in Nigeria and the UK. It was possible to purchase Airtel Africa shares on the NGX Exchange in Nigeria, cancel those same shares and have them reissued (at a ratio of one-for-one) in the UK and then sell them on the London Stock Exchange for pounds sterling.

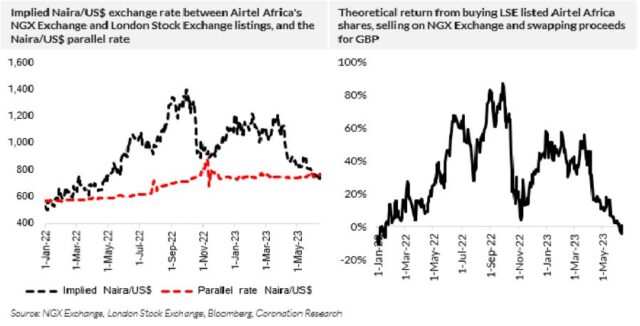

As to whether this was a good deal, it depends on what the participants were looking for. In purely economic terms, from 1 January 2022 until now, the implied Naira/US$ exchange in the trade (also reflecting GBP/US$ exchange rates) has averaged N1,148/US$1 compared with an average in the parallel exchange rate of N683/US$1 over the same period. Clearly, it was pricey.

The advantage of the trade lay in regulations and compliance. Participants in the N/US$ parallel market either dealt in cash or in currency swaps. While cash transactions and currency swaps are legal, they can be frowned upon by certain classes of regulator, including internal regulators such as supervisory boards and trustees.

Participants in the share deals, by contrast, dealt with a Nigerian-licensed stockbroker, both Nigerian and UK registrars, and with a UK-licensed stockbroker in the final leg the transaction.

It looked good from the compliance angle, even though it was responsible for a remarkable elevation in the price of NGX Exchange-listed Airtel Africa shares.

And that elevation encouraged another trade. It was possible, at various times, to purchase Airtel Africa shares in the UK, have them cancelled and reissued in Nigeria, then sell the Nigerian shares on the NGX Exchange and swap the Naira proceeds back into pounds sterling in the parallel market.

For example, in early February 2023 it was possible buy Airtel Africa shares in the UK for GBP1.134, cancel them and have them reissued in Nigeria, sell them at N1,660/share, swap the proceeds back into pounds sterling at a parallel rate of N901.79/GBP1, and make a gross profit (excluding charges) of 62.3%.

Factoring in the costs of brokerage, custody and foreign exchange transactions at some 10%, we come to a percentage return on such a transaction of 56.1%.

As our chart shows, the economics of this trade recently ceased to make sense, as the implied exchange rate between the two listings has trended towards the parallel rate. The arbitrage between the listings was a legacy of the extraordinary conditions caused by multiple Naira/US dollar exchange rates.- With Coronation Research Report

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com