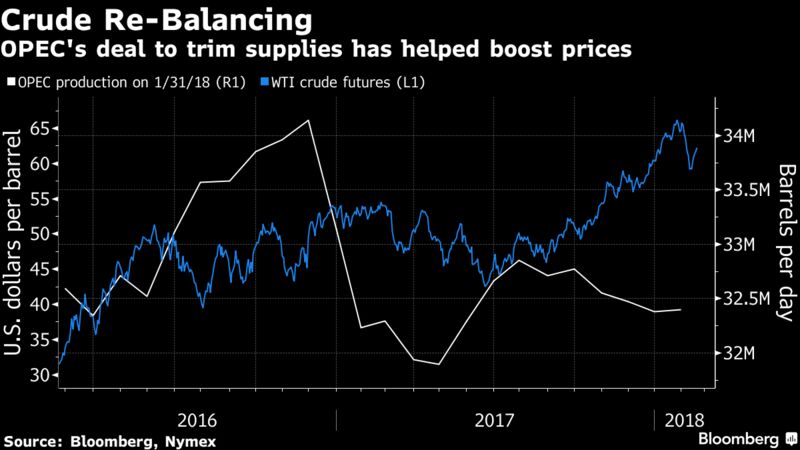

FEBRUARY 20, 2018 – Brent crude traded near the highest in two weeks as OPEC concluded the market’s journey toward equilibrium is gaining speed.

Oil is struggling to regain the highs of January after a sell-off in global equities seeped into crude markets earlier this month. Surging U.S. production continues to challenge efforts by the Organization of Petroleum Exporting Countries to alleviate a global oversupply, with forecasts pointing to record output from the Permian shale basin.

Brent for April settlement dropped 0.7 percent to $65.19 a barrel on the London-based ICE Futures Europe exchange as of 9:58 a.m. local time. Prices added 83 cents to close at $65.67 on Monday.

West Texas Intermediate for March delivery, which expires Tuesday, rose 0.7 percent to $62.12 a barrel on the New York Mercantile Exchange. Monday’s transactions will be booked Tuesday for settlement because of the U.S. Presidents’ Day holiday. The more active April contract was at $62.03.

The OPEC and non-OPEC technical committee estimates that oil inventories are about 74 million barrels above the five-year average and participants’ compliance with cuts was 133 percent in January, according to people familiar with the matter. The panel’s forecast for the market reaching equilibrium later this year assumes that Libya and Nigeria keep output at January levels and other participants in the deal maintain full compliance with cuts.