TUE SEPT 10 2024-theGBJournal| August saw a big rally in the Federal Government of Nigeria (FGN) bond and Treasury bill (T-bill) markets, with average yields in the T-bill market declining by 397 basis points (bps) to 21.21% per annum (pa).

The technical reason for this was a high level of liquidity at August’s T-bill and FGN bond auctions, combined with a small volume of FGN bonds offered.

The monetary authorities are able to influence Naira market interest rates via the auctions, and it appears that they are happy with market rates moving downwards, even though they raised the Monetary Policy Rate (MPR) from 26.25% to 26.75% in July.

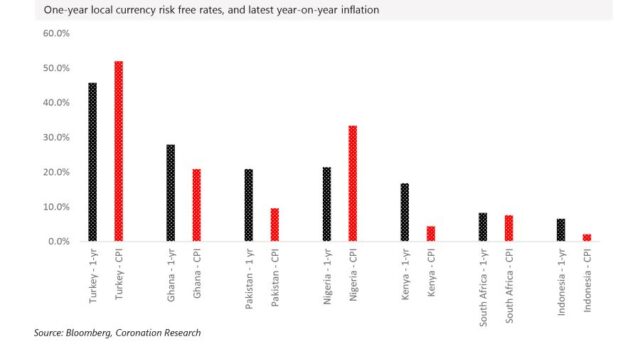

Are these Nigerian rates high? For many businesses, the answer is, “Yes, too high”. But although Nigerian inflation has moderated, from 34.19% y/y in June to 33.40% y/y in July, market interest rates are substantially below these levels – by almost 12 percentage points when comparing inflation with 1-year risk-free rates.

An international comparison suggests that rates need to be higher than this in order to combat inflation.

In the above chart we make a comparison between local currency risk-free rates (government-issued T-bills) and their respective inflation rates.

In most places the 1-year risk-free rate is comfortably above the level of inflation, encouraging domestic savers to keep their money in the local currency and even encouraging foreign investors to buy local-currency T-bill and bonds.

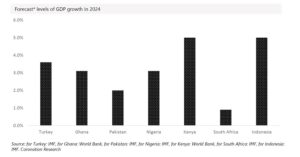

Some business people argue that high interest rates kill off growth. Yet there is little evidence of this. Ghana has higher market interest rates than Nigeria yet it has comparable economic growth prospects for 2024.

Two countries forecast to enjoy high GDP growth this year, Kenya and Indonesia, have 1-year risk-free rates much higher than their respective inflation rates. We argue that getting inflation under control is the key to strengthening markets and encouraging investment.

Although this argues for putting Nigerian market interest rates up, it does not follow that they are headed that way.

We sense that Naira market liquidity remains strong, that the monetary authorities are not minded to issue more government debt (debt servicing costs are an issue) and we may see rates moderate further.-This note is written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com