MARCH 29, 2018 – A few weeks ago, Aviva’s emerging-market debt funds were cutting back on risk amid rumblings of a global tariff war. Today? They’re wading into some of the world’s most speculative investments: frontier market bonds.

At the height of concerns over a potential trade war, Aviva eliminated some of its short dollar positions, made bearish bets on South Korean assets versus the Japanese yen and moved from overweight to neutral on local-currency bonds.

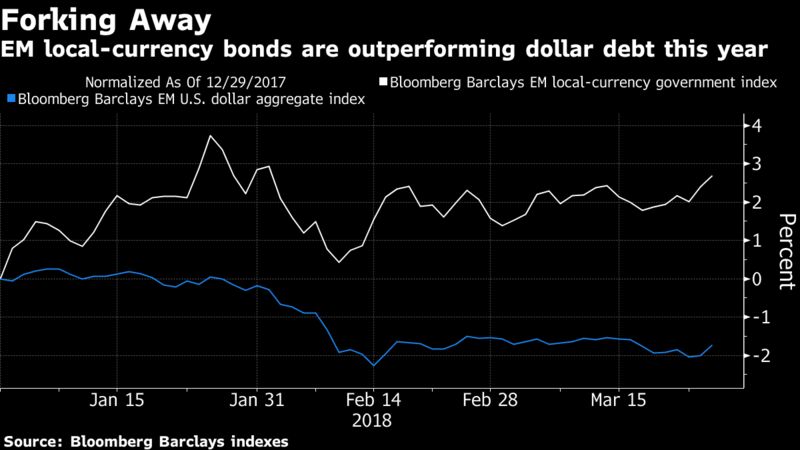

With tensions abating, Aviva is back in the market for risk. This time, however, the $446 billion money manager is being more selective. Rallies in uncorrelated assets spurred by perpetual capital flows are a thing of the past, according to the firm. Taking its place: a two-speed market where volatility creates stark divisions between winners and losers.

In the foreign-currency bond market, Aviva is avoiding extremes. On one side, it places countries like Poland, Philippines and Peru, where risk premiums have narrowed so much as to make the bonds virtually “uninvestable,” according to Aaron Grehan, a London-based money manager at the firm. On the other side are higher-yielding bonds that it sees as most at danger from rising volatility.

“We are now focused on mid-beta markets,” Grehan said. “We are avoiding low-spread markets like central and Eastern Europe, as well as parts of Asia, but we are also cautious on high-yield names.”

Aviva’s favorite bets in the dollar-bond segment are Egypt, Ukraine, Paraguay, Argentina and corporate bonds in Brazil.

The risk premium for emerging-market sovereign dollar bonds over U.S. Treasuries widened 3 basis points to 304 on Thursday, according to JPMorgan Chase & Co. indexes.

When it comes to local-currency debt, Aviva is driving deep into frontier territory. The money manager is building a basket that includes Sri Lanka, Uruguay, Kazakhstan, Ghana and Nigeria, on the theory that increased domestic ownership of these bonds will make them less sensitive to global market swings.

On the other hand, more mainstream emerging markets with greater foreign ownership — such as South Africa, Turkey and Brazil — could face whiplash from a Federal Reserve interest rate increase or a trade war.

While the wider investing world has always looked at frontier markets as the riskier end of the developing world, they can actually be safer asset-allocation bets, according to the firm. In fact, Spillane said he expects frontier markets to account for 10 percent or more of Aviva’s portfolios as they grow in size and investor acceptance.

“As long as you get your fundamental story right, the smaller and less-owned markets offer an interesting proposition,” he said. “They offer attractive yields and provide an element of diversification.”