JANUARY 5, 2018 – Angola is poised to become the latest emerging nation to abandon its currency peg as it seeks to rescue an economy still reeling from the oil-price crash four years ago.

It joins a long list of commodity exporters — from Russia to Egypt, Kazakhstan, Nigeria and Uzbekistan — that have floated or devalued currencies in a bid to end crippling shortages of foreign exchange and revive economic growth.

The move underlines just how forcibly President Joao Lourenco is trying to bolster his nation’s finances, three months after he replaced Jose Eduardo dos Santos, who ruled for almost four decades.

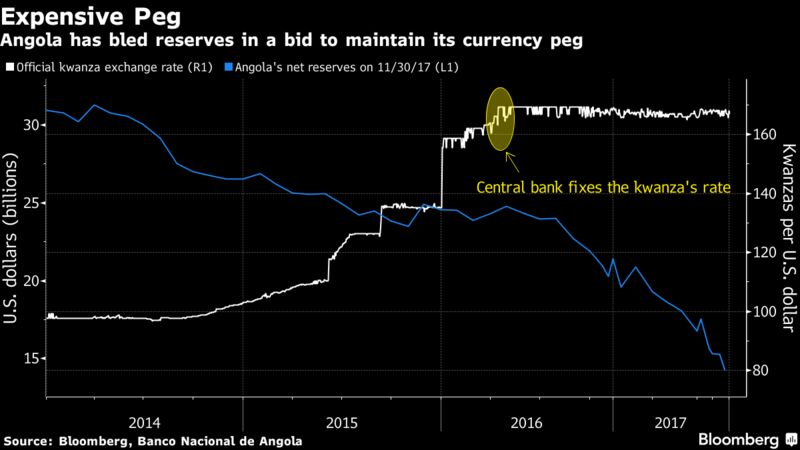

Angola, which relies on oil for more than 90 percent of exports, kept a tight grip on its currency as the commodity slid. While the kwanza has already weakened 40 percent to 166 per dollar since mid-2014, analysts say it’s still too strong. Charles Robertson, Renaissance Capital’s chief economist, said in a note Thursday that the kwanza was the most overvalued of the more than 50 currencies he analyzes and that its fair value was 348 to the greenback.

The currency has tumbled to 430 on the black market as dollars run dry, leaving hundreds of companies struggling to pay foreign workers and overseas suppliers. Economic growth fell to zero in 2016 after averaging almost 9 percent per year during the previous decade.

Angola has bled reserves — which more than halved in the past four years to the lowest since 2010 — to defend the peg. The dos Santos administration said it was the best way for the import-dependent nation to curb inflation, which stands at 28 percent.

It could take a currency depreciation of 30 percent during the next year to improve Angola’s fiscal balances while also ensuring foreign debts remain manageable, according to Neuberger Berman’s Nazli.

Still, a devaluation alone may not be enough given the nation’s tight capital account controls and lack of kwanza-denominated securities to attract investors, according to Paarl, South Africa-based NKC African Economics. Angola is one of the few major African economies without a stock exchange.

Finance Minister Archer Mangueira said late Wednesday that he would also “renegotiate our debt with our main partners throughout 2018.”

After his statement, yields on the government’s dollar-denominated $438 million of securities due in 2019 rose 25 basis points, although yields fell on its $1.5 billion of Eurobonds due in 2025. The Finance Ministry later said it was committed to servicing both foreign and local debt.

Much of Angola’s roughly $40 billion of foreign debt is in the form of bilateral lines from nations such as China or loans taken on by state oil company Sonangol.

“The government is more likely to focus on renegotiating the Chinese loans and the debts taken on by Sonangol,” said Nazli. “The Eurobonds only make up a small proportion of the external debt.”