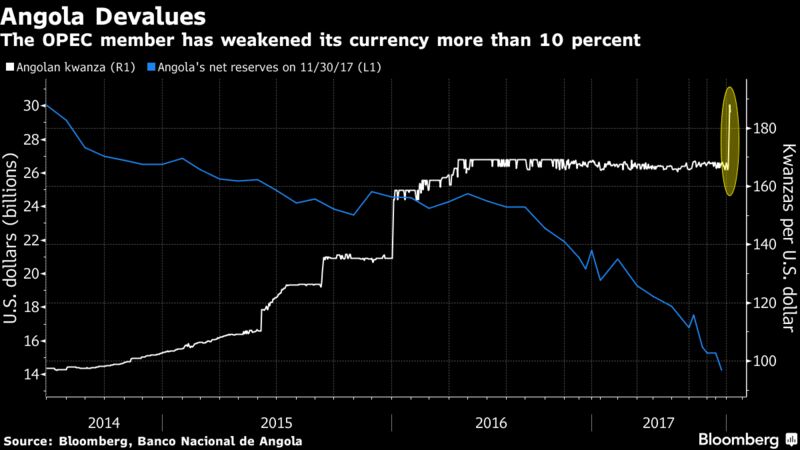

ANGOLA, JANUARY 12, 2018 – Angola may have devalued its currency by more than 10 percent, but it will take more than that to end dollar shortages and revive the OPEC member’s battered economy.

Africa’s second-biggest oil exporter joins a long list of commodity producers, from Russia to Kazakhstan and Nigeria, that have floated or devalued currencies in recent years to stop bleeding reserves. Angola’s cash pile more than halved since 2014 as it tried to defend the peg.

New Governor

The move is part of President Joao Lourenco’s efforts to attract investment just three months after replacing Jose Eduardo dos Santos, who ruled the former Portuguese colony for almost four decades. Lourenco had already shaken up the economy by appointing a new central bank governor and sacking Isabel dos Santos, the former president’s daughter, as head of the state oil company. This led him to be depicted by Angolans on social media as The Terminator, Arnold Schwarzenegger’s movie character.

On Wednesday night, Lourenco dismissed Dos Santos’ son, Jose Filomeno dos Santos, as head of Angola’s $5 billion sovereign wealth fund.

“A request for IMF assistance is more likely now that elections are over, and given government changes and reduced access to external funding,” he said. “Overall, a weaker currency was needed and the new currency regime is a step in the right direction, especially in terms of seeking IMF financial assistance.”

Trading Band

Angola’s new central bank governor, Jose Massano, said last week he would let the exchange rate be decided in currency auctions, which restarted on Tuesday after a two-month gap. The BNA will set a trading band — though it won’t be publicly disclosed — and continue to intervene in the market to prevent the kwanza depreciating too much and to curb inflation, which stands at 28 percent.

While Brent crude prices are still well below levels of mid-2014, their increase of more than 50 percent since June to almost $70 a barrel probably led Angola to weaken the kwanza by less than it would have otherwise done, according to Absa Bank Ltd.

“A 10 percent devaluation was probably much less than the market was expecting,” said Samantha Singh, a Johannesburg-based strategist at Absa. “Unless oil prices continue to rally, further currency adjustments are warranted.”