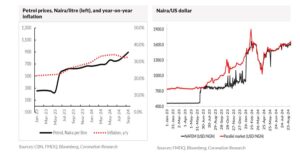

TUE NOV 05 2024-theGBJournal| Inflation in Nigeria has risen to 32.70% year-on-year, food inflation is 37.8%, the price of petrol is up 66.4% in a year, and borrowing costs reflect the Monetary Policy Rate which is up by 8.5 percentage points to 27.25% over a year. The US dollar value of the Naira is down by 51.4% over a year.

Which institution now gives Nigeria a good score? The answer is the World Bank, which rates Nigeria highly in its latest development update. Though the picture today is bleak, the success of the reform process makes the future look better, in our view.

In its most recent Nigeria Development Update publication, for October 2024, the World Bank gives an upbeat assessment of Nigeria’s reforms.

High scores are received for foreign exchange policy, monetary policy and fiscal policy. The World Bank records a transformation over the past two years.

What is the World Bank referring to? Surely not to business conditions and living standards. Rather, the World Bank is pointing out the progress made in policies that it believes lay the foundation for future growth.

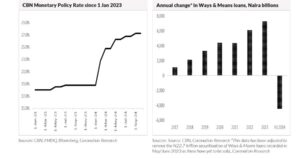

We can identify some of these drivers. If we accept that one of the main drivers of inflation in the period 2017- 2023 was the creation of Ways & Means loans (unfunded loans from the CBN to the Federal Government) then the reversal of this process in the first half of 2024 comes as good news.

Together with high monetary policy rates and elevated 1-year T-bill rates, it suggests that inflation can be brought under control.

This is not to say that inflation will come down quickly. The rise in fuel prices creates cost-push inflation that will put upward pressure on prices soon, as will Naira/US dollar depreciation.

But the point here is that the rise in fuel prices was caused by the effective removal of fuel subsidy. That means that there is not much scope for fuel prices to rise again, and it means that government is saving money (which, indirectly, is good news for inflation if government keeps the savings and does not increase its debts).

None of this is much comfort to Nigerians struggling with the cost of living, nor to businesses struggling with the cost of debt (though it is of some comfort for savers when 1-year T-bill rates are up from 15.75% a year ago to 24.00% today).

The pain endured in the reform process must have a payoff, and that payoff can only be that 2025 will be a better year than 2024. In our view, international investors will follow the cue from the World Bank.

We therefore expect more investment in 2025 than in 2024, lower inflation, and less currency depreciation.-By Coronation Research

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com