TUE, JULY 25 2023-theGBJournal |Foreign portfolio investment in Nigeria declined steeply after 2019 as risk-free yields on Nigerian Treasury Bills declined.

That happened as the Covid-19 pandemic was about to sweep around the world, disrupting economies and depressing oil prices which, in turn, caused the Central Bank of Nigeria (CBN) to lessen its hitherto generous supplies of US dollars to the foreign exchange markets (from April 2020 onwards), and causing the parallel market exchange rate to break away significantly from the official Naira/US dollar rate.

These were dark days for foreign investors, especially those attempting to repatriate dividends, coupons or principal investments.

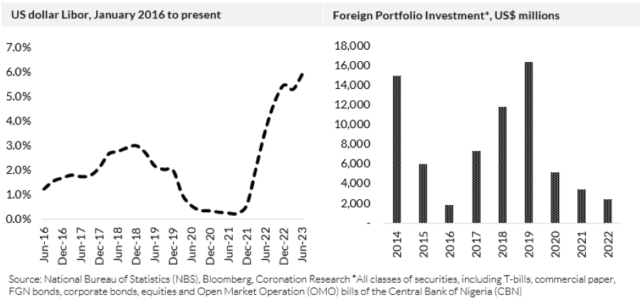

In 2018 and 2019 foreign portfolio investment (FPI) was at truly enormous levels, over 10 times the level of foreign direct investment (FDI). The bulk of this money was not in the equity market but in the Open Market Operation (OMO) bills of the CBN and in Treasury Bills. There were, therefore, two problems.

None of these securities had a duration of more than one year, so the money would have to be paid back quickly. And the foreign investors would head to the foreign exchange market to get back their US dollars. It could only ever be a short-term measure of maintaining foreign capital in the country (unless the securities could be rolled over endlessly).

The second problem was that the fixed income trade depended on there being cheap US dollars which international funds could borrow (the US dollar Libor chart above gives an indication of these rates) and high-yielding Nigerian T-bill to invest in, at around 20.0% pa or more. Now that US dollar Libor is close to 6.0% and a 342-day Naira T-bill yields 6.27%, this trade no longer works.

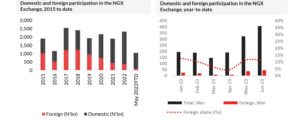

What about equities? Foreign participation in the Nigerian equity markets used to run at high levels, sometimes accounting for 50% of turnover (see 2015). But that was long ago.

Successive years of negative equity market performance (2014, 2015 & 2016, followed by 2018 & 2019) were discouraging, to say the least. Problems with repatriation of dividends and principal, notably in 2016 and again in 2020, were also off-putting.

Even through the NGX Exchange All-Share Index recorded three straight years of positive returns in 2020, 2021 & 2022, the share of foreign investors in trading fell during this period.

This is not to say that the foreign investor is absent from the equity market. Foreign participation jumped by 84% from January to June this year, but relative to overall turnover it only kept pace. Year-to-date it has accounted for some 10% of the market.

Following many changes in the foreign exchange and interest rate environments and following many disappointments in the equity market (and despite the last three years’ performance), we doubt that the foreign portfolio investors will return in force, and we do not expect this to change between now and the end of the year.Analysis is provided by Coronation Research.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com