TUE, MAY. 09 2023-theGBJournal|The last time Nigeria’s financial markets went through sustained turmoil was from the beginning of the fourth quarter of 2014 through to the end of 2016, a two-and-a-quarter-year period when the official exchange rate fell from N168.86/US$1 to N315.33/US$1, the equity market fell by 34.8% and the foreign exchange reserves of the Central Bank of Nigeria (CBN) fell from US$39.5bn to US$25.9bn.

Nigeria went into a recession lasting five quarters from the beginning of 2016 up to and including the first quarter of 2017.

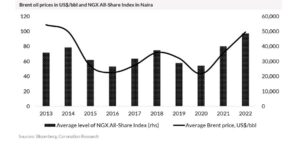

A sharp fall in oil prices was the immediate cause of the 2105-2016 crash, the price of Brent starting with a 41.0% decline in Q4 2014 from US$97.20/bbl to US$57.33/bbl, falling a further 35.0% to US$27.33/bbl by the end of 2015, before recovering to US$56.82/bbl by the end of 2016.

Falling oil prices undermined US dollar inflows to the CBN via the Nigerian National Petroleum Corporation (NNPC), caused foreign exchange reserves to fall and reduced government revenues.

Of course, there was also considerable turmoil at the onset of the Covid-19 pandemic in 2020, with a sharp correction in the oil price (the price of Brent fell from US$66.00/bbl at the beginning of the year to US$20.46/bbl by the end of April) and a severe recession lasting two quarters (Q2 and Q3 2020), but the pain was short-lived.

The US dollar value of the Naira lost 7.5% at the I&E Window over the year and the equity market ended the year 50.0% higher than its opening level.

Take care when Brent closes on US$60.00/bbl

Nigerian investors need to keep an eye on oil prices. This not because Nigerian financial markets correlate with the oil price: they do not (the correlation between oil prices and the NGX All-Share Index over time is weak when using daily data, for example).

It is because a severe and sustained fall in oil prices can wreak havoc with Nigeria’s balance of payments, US dollar inflows, foreign exchange reserves and exchange rate.

These in turn negatively impact foreign exchange liquidity, foreign investment flows (both direct and portfolio investment), corporate earnings, the equity market and, indirectly, Naira market interest rates.

Weakness in Brent crude prices over the past month is not an immediate cause for concern, even if Brent at US$75.30/bbl is only on par with the US$75.00/bbl set in the current 2023 government budget. Brent has traded at an average US$82.03/bbl year-to-date (compared with an average of US$99.09/bbl during 2022).

By contrast, we would raise red flags if Brent were to trade at under US$60.00/bbl for a sustained period of time. As a rule of-thumb, sustained Brent prices below US$60.00/bbl, and more particularly below US$50.00bbl, are strongly associated with falls in foreign exchange reserves and dislocation in the Naira foreign exchange market, with knock-on effects on Naira equity and fixed income markets.

Why worry about the effect of weak oil prices so soon, when the danger level – around US$60.00/bbl – has not been reached? The answer is that markets react very quickly to sharp declines in oil prices. The equity market reacted swiftly to oil price declines in late 2014 and continued to do so in 2015.

Although the overall correlation between Brent prices and the equity market over the past 10 years is weak (r2 of 46% using daily data), the correlation rises in times of crisis (the r2 was 71% in Q4 2014 and 66% during 2015), suggesting that investors need to be particularly aware of sharp and sustained oil price falls.

Oil price drivers in 2023

The latest bout of weakness in global oil prices has to do with the slack in the global economy rather than an attempt on the part of producers to alter the market. In late 2014 it was clear that major producers, notably Saudi Arabia and Russia, wanted to increase their market shares because they were concerned about the rising share of US shale producers.

Estimating the marginal cost of production in US shale fields to be around $60.00-70.00/bbl, their aim was to boost their own production, see prices fall for a long period (during 2015), drive a segment of US shale producers out of business and regain global market

share.

Today, by contrast, no such agenda has been declared. In fact, Saudi Arabia and Russia appear more interested in supporting prices than seeing them fall.

Just over a month ago OPEC and Russia (OPEC+) announced a surprise cut in scheduled production levels, prompting a rally in oil markets, Brent touching a peak of US$87.33/bbl on 12 April. If this was a strategy to elevate prices, it failed as prices soon waned in the face of sluggish global demand.

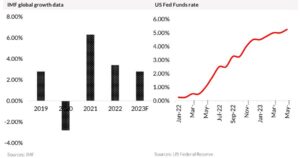

Data for global economic growth has not matched expectations, with first-quarter US GDP growth at 1.1% year-on-year against expectations of 2.0% year-on-year and prior-quarter growth of 2.6% year-on-year, while the level of Russian crude oil output itself seems not to have abated. low economic growth and high output have combined to make oil traders wary.

Concerns over the pace of global economic growth have weighed on oil, as well as other commodities, including soft commodities such as wheat, maize, palm oil and rubber.

While developed market equities are surging in 2023 on the back of strong corporate results and the prospect of interest rate cuts later in the year (equity markets are typically good at forecast economic rebounds) commodity markets are becalmed.

One way of looking at this is to think of equity markets as predicting a rebound in economic activity in six-to-nine months’ time while commodity markets are still looking for evidence of it.

Conclusion

What to make of the current weakness in global oil prices? We believe that it is too early to take evasive action, i.e. sell Nigerian equities, as the recent correction is not particularly sharp, cannot be said to be sustained (yet) and may indeed revert.

There is no concerted attack on oil prices (as there was in 2014) and it seems likely that those with an interest in Brent trading higher than US$80.00/bbl, notably members of OPEC, may cut production again in order to support prices.

Analysis is written and provided by Coronation Research.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com