WED, 20 JULY, 2022-theGBJournal| The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) unanimously voted on Tuesday to increase the Monetary Policy Rate (MPR) by 100bps to 14.0% – the second consecutive rate hike to the highest level in 42 months.

The hike brings the total rate increase so far in 2022 to 250bps, representing the largest annual increase since 2011FY (+575bps).

Based on the voting pattern, six members voted to increase the MPR by 100bps, three voted for a 50bps hike, one voted for 150bps, while the final member voted for a 75bps increase in the MPR. Asides from that, the Committee also voted to retain the asymmetric corridor around the MPR at +100bps/-700bps, Cash Reserve Requirement (CRR) at 27.5%, and Liquidity ratio at 30.0%.

Market Impact

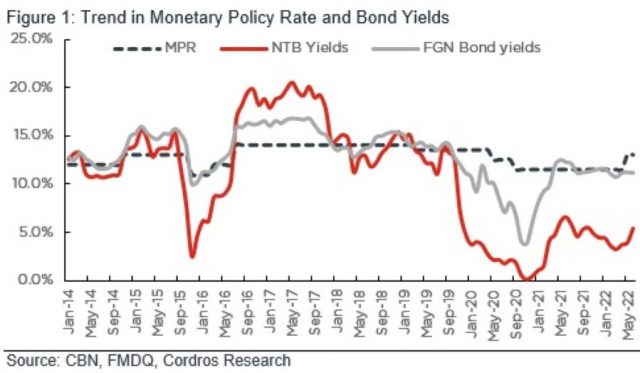

Fixed Income: Before this meeting, the average stop rate at the bond auction on 18 July closed higher by 67bps at 12.58% (June auction: 11.92%) – significantly above the 10bps increase at the June auction compared to the May Auction (11.82%).

Asides that, we highlight that investors sold off the long end of the curve since the last policy meeting, as the average yield closed higher at 12.73% on 18 June (+25bps vs 24 May: 12.48%). We believe the outcome of this meeting will trigger another round of selling activities on the long end of the yield curve.

Consequently, we maintain our view that investors should remain wary about duration risk given our expectations of a tight monetary posture from the CBN, as evidenced at this meeting. Overall, we see scope for a continued uptick in FI yields as tightening global financing conditions will compel the government to increase reliance on the domestic market to finance borrowings.

Equities: Following the recent decision of the MPC, we do not expect a knee-jerk reaction to the meeting’s outcome, especially as the hike coincides with the commencement of the H1-22 earnings season.

In the interim, we believe the full swing of the H1-22 earnings season will dictate market sentiments and possibly drive positive performance as investors hunt for bargains in fundamentally sound stocks with a consistent history of interim dividend payments.

Notwithstanding, we envisage intense selling pressures on stocks of companies that grossly underperform in H1-22. Subsequently, as domestic investors remain the dominant players in the market (92.5% market share as of May 2022), we believe sensitivity to an uptick in FI yields will remain a downside to market performance in the medium term. As such, we expect sentiments to remain broadly positive until FI yields begin to inch up.

Before this meeting, analysts, including Cordros Research had expected the Committee to

Although the Committee agreed with Cordros thought that the last hike had not permeated enough in the economy, we believe the decision to hike must have been induced by the sharper month-on-month inflation reading in June (+4bps to 1.82%).

The higher month-on-month increase points that further strengthening of monetary policy tightening is needed to effectively curtail the unabating inflationary pressures. Moreover, we think the MPC is trying to be proactive – moving ahead of the US fed which is expected to increase its key policy rate by 75bps at its next meeting on 27 July – to ensure that the impact on the domestic economy would be limited. Indeed, the Committee highlighted that the tightening was needed given the need to signal a strong determination of the bank to aggressively address its price stability mandate and narrow the real interest rate gap.

Further out, the Committee highlighted that though output growth remains fragile, not containing the rising consumer prices now could derail the moderate gains achieved in improving consumer purchasing power, worsening poverty levels. Thus, the Committee advised the CBN to continue to use its development finance initiatives to ensure that output growth remain in focus.

Overall, we think the pace of monetary policy tightening by systemic global central banks at their July policy meetings and what happens to global growth and inflation afterwards would provide the much-needed guidance as to how the MPC would react going further into the year.

If global inflationary pressures persist and recession is avoided in key economies, we would expect global central banks to march on with the aggressive rate hikes to combat the unabating inflationary pressures. In that case, we envisage that the MPC would raise the MPR by 50bps at the September policy meeting to limit external pressures in the face of rising yields in advanced economies.

However, if recession is not avoided in advanced economies, we expect the global central banks to slow down their interest rate hiking cycle. Thus, we would expect the MPC to hold off increasing the MPR until the November policy meeting as it tries to ease the burden on government borrowing costs.-With Cordros Research

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com