…Investors in Federal Government of Nigeria (FGN) Eurobonds are typically international investors, sensitive to what happens to the reform program.

…Recent developments have been disheartening, though we still favour short-dated FGN Eurobond maturities.

TUE AUG 13 2024-theGBJournal|Since the onset of the current administration in May 2023 the international Eurobond market has shown its approval of Nigeria’s reform process. Specifically, prices of Federal Government of Nigeria (FGN) US-dollar denominated Eurobonds have rallied, with yields coming down.

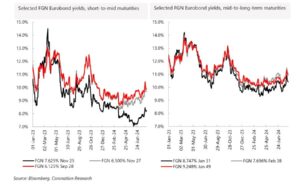

At least, this was the case until late March 2024 when yields reached their lowest point in years.

More particularly, we have seen a rise in yields since mid-July. Since 15 July the average yield of short-to-medium duration FGN Eurobonds (our selection consists of the November 2025, November 2027 and September 2028 maturities) has risen by 69 basis points, while the average yield of mid-to-long durations (we have selected the January 2031, February 2038 and January 2049 maturities) has risen by 75bps.

What has caused the market to behave in this way? We think there are four recent developments which the Eurobond market has interpreted negatively.

The first, announced in early July, was a proposed supplementary government budget of N6.6 trillion ($4.2 billion), coming on top of the 2024 budget of N28.7 trillion. Later in the month it was announced that the minimum wage would rise from N30,000 to N70,000/month (US$44.5/month).

This is a paltry sum, in our view, but nevertheless a figure setting a base line in pay negotiations of more than double its predecessor.

Both these moves are inflationary. The market, naturally enough, questioned how these increases are to be funded.

The third item of negative news was the proposal that the limit on so-called Ways and Means loans, which constitute unfunded lending from the Central Bank of Nigeria to the FGN, is to be raised in 2025 from the equivalent of 5.0% of government revenues to 10.0%. This has inflationary implications.

Fourth came the news, last week, that Fitch Ratings has taken its rating of Dangote Industries down to B+, from AA, citing currency losses in 2023 and ‘significant deterioration in the group’s liquidity position’.

The Eurobond investor is typically international, and international investors often see Dangote Industries as synonymous with Nigeria itself.

So close and yet so far

Meanwhile, spare a thought for the Debt Management Office of Nigeria (DMO) which may have sensed, back in March, that an opportunity to issue new Eurobonds was close at hand.

By 26 March the average yields of our selection of FGN Eurobonds (this time we omit the short-dated November 2025 maturity) had come to within 1.6 percentage point of their coupons, on average.

A little more price appreciation would have taken yields to the point where it was affordable for the FGN to issue fresh paper, in our view.

Alas, it was not to be. The market has sold off and yields are now, on average, 2.7 percentage points above their coupons. This does not rule out the FGN making a Eurobond issue this year, but it suggests that a renewed period of price appreciation would help the process along.

Value at these levels?

Where does this leave FGN Eurobonds from an investor’s point of view? Clearly the market is asking questions about the reform process and this comes at a time when other African sovereign issuers have seen their bonds marked down.

At the same time, the CBN’s gross foreign exchange reserves are still trending upwards, and the overall pool of FGN Eurobond debt is quite small and the government is in no mind to renegotiate it.

We favour short-dated maturities, November 2025 (with a mid-yield at close of business on Friday 9 August at 8.16% pa) and November 2027 (9.68% pa) over longer-dated maturities-Analysis is written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com