…So, the question is whether we are set for a similar drop in inflation during the second half of 2024.

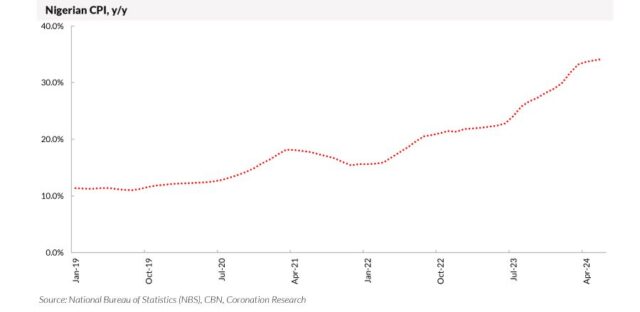

TUE AUG 20 2024-theGBJournal| Last week inflation fell from 34.19% y/y to 33.40% y/y (for July). This was the first fall in inflation since December 2022 and the fixed income markets welcomed it.

But does this herald a fall in FGN bond rates and T-bill rates over the months ahead? There may well be a short-term dip in rates, but we think the monetary authorities will keep rates high for a while yet.

To give credit to the monetary authorities, the fall in inflation in July was the first since December 2022, which itself was a blip, a single month’s fall of 12bps to 21.34%. One has to go back to the period from April to November 2021 for a meaningful drop in inflation (278bps over eight months to 15.40%).

So, the question is whether we are set for a similar drop in inflation during the second half of 2024. Note that core inflation still rose from 27.40% in June to 27.47% in July. The CBN may argue that its regime of high interest rates is having positive effects, but there will be naysayers.

One data series we keep an eye on is money supply, in particular the broad M3 measure. These data would normally be the target of a high-interest rate regime. Yet here we note a recent growth rate in M3 of 56.1%, y/y (for June). This suggests that high interest rates are not reducing, or have not yet reduced, the creation of credit.

And if credit increases faster than the supply of goods and services, that is a recipe for inflation.

Even if the money supply was under control, and even if inflation continues to fall (which we think it will, gently) we still would not expect the interest rate regime to change. The obvious signal is that the Monetary Policy Council of the CBN put up its Monetary Policy Rate (MPR) by 50bps to 26.75% as recently as 23 July.

The more general reason is that central banks tend to play safe and wait for a sustained fall in inflation before cutting rates. (The Federal Reserve in the US this year is a case in point.) And T-bill rates are well short of the rate of inflation.

There may well be further strength in T-bill and FGN bond markets over the short term but we believe that the monetary authorities will want to sustain high rate for several months yet.-Analysis is provided by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com