…Ways Means loans are loans from the Central Bank of Nigeria to government. Used excessively and we argue they have been in recent years contributed to the devastating rise in inflation.

…The good news is that recent data shows the CBN starting to bring the problem under control.

…We do not think inflation will fall swiftly now, but we do observe a coordinated policy to reduce it See

WED OCT 09 2024-theGBJournal|In recent months we have heard a lot about the Ways Means loans of the Central Bank of Nigeria (CBN).

These were mentioned during the President’s National Broadcast on Independence Day, 1 October, and featured in a press release from the Debt Management Office back in July. What accounts for the prominence of this obscure central bank financing tool?

The answer is that Ways & Means loans are widely thought to be bad, when used excessively, and are associated with the rise of inflation.

The monetary authorities have something to celebrate now because they are beginning to bring the problem to heel Although, in our opinion, the problem is a very large one, it is clear that progress is being made.

Ways & Means loans are designed to be small and temporary loans from the CBN to the Federal Government of Nigeria to tide it over during difficult times. The critical thing about Ways & Means loans is that they are unfunded.

Whereas the FGN’s issues of T bill and FGN bonds are funded, and therefore take money out of the system by raising it from pension funds, mutual funds, banks and from the public, Ways & Means loans are unfunded. They therefore increase the supply of money and contribute to inflation

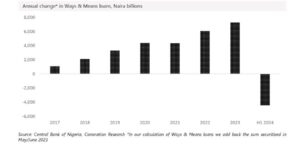

And the problem is that Ways Means loans have become very large. Our measurement of CBN data shows that the annual disbursement of Ways & Means loans rose from just over N 1.0 trillion in 2017 to nearly N 7.3 trillion in 2023 a compound annual growth rate of 37.4%. These were the years when inflation rose dangerously.

Some would argue that our data for Ways & Means loans in 2023 is wrong, because during May and June that year some N22.7 trillion of Ways & Means loans were securitised, i.e. turned into a formal bond whereby the FGN is to pay 9.0% pa interest over 40 years.

This N22.7 trillion no longer appears in the official Ways & Means data. But we note that the sum of N22.7 trillion was not actually sold to investors the bond is owned by the CBN. So, in our calculations we have added it back.

The good news is that the process of increasing Ways & Means loans went into reverse in the first half of 2024. The Debt Management Office began to fund previously issued Ways & Means loans, essentially by repackaging them as T-bill and FGN bonds and selling them. Some N4.9 trillion was dealt with.

Will this bring down inflation? It certainly is a positive factor in reducing inflation but recent fuel price increases introduce another source of inflation (cost push inflation). Unfortunately, we do not see inflation coming down quickly this year.

The positive sign is that, taken together with last month’s rise in the Monetary Policy Rate from 26.75% to 27.25% the approach of the authorities in tackling inflation is coordinated That is a start.-Written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com