TUE, MAY. 16 2023-theGBJournal |A rise in US rates of 5.0 percentage points over fifteen months has changed the world.

It has seen Nigerian Eurobond rates shoot up and brought crisis to countries like Ghana.

Yet the rate rises may be paused going forward, which brings hope to Nigerian Eurobond investors

Post-Covid-19, the US Federal Reserve pumped money into the US financial system and kept rates at a record low in order to drive economic growth. The resulting increases in money supply and household spending, combined with supply chain issues, caused inflation to rise sharply.

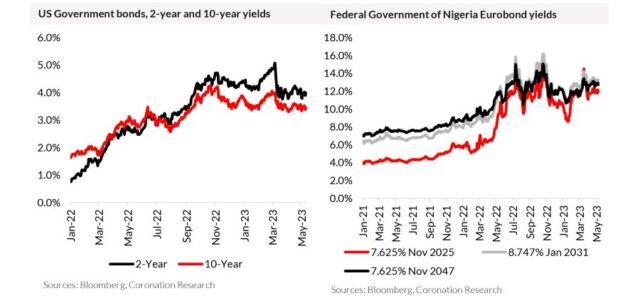

Subsequently, and last year, the US Fed embarked on a rate hike cycle to bring down inflation. The US Fed rate is currently at a 16-year high and has significantly impacted emerging markets. When will the US Fed end its monetary tightening campaign?

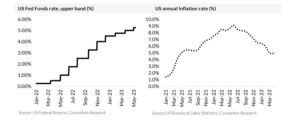

At its last meeting in May, the US Federal Open Market Committee (FOMC) hiked its benchmark rate by further 25bps to an upper limit of 5.25%, in line with market expectations. However, the committee gave a less hawkish commentary than at previous meetings as it highlighted that “in determining the extent to which additional policy firming may be appropriate,” the committee would look at how the economy, inflation, and markets behave over the coming weeks.

Without implying anything in particular, this was the same statement the FOMC had made in 2006 when it paused its tightening cycle. According to the FOMC, the key indicators it is keeping watch on include inflation, labour data, the debt ceiling standoff, and the banking sector’s health.

The latest inflation data showed that consumer prices increased by 4.9% year-on-year in April, compared with a 5.0% y/y rise the previous month. Although headline inflation remains above the Fed’s target of 2.0%, the inflation data for April marked a steep decline from its recent high of 9.1% y/y in June 2022.

Also, the Fed’s preferred inflation gauge, personal consumption expenditures (PCE) fell to 4.2% y/y in March from a 40-year high reached last June.

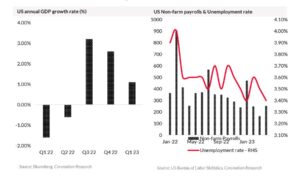

Regarding economic growth, preliminary Q1 GDP data came in lower than expected at 1.1% y/y compared to 2.6% y/y in the previous quarter. The 1.1% data was well below consensus market expectations of 2.0% y/y, indicating that interest rate rises are causing the economy to cool off.

The US Fed also looks at signals from the job market. Recent data from the US Department of Labor showed the economy added 253,000 jobs in April while the unemployment rate declined to 3.4%, the lowest since 1969.

The implications of these data pointed to a strong economy and ran counter to the GDP data, casting doubt over the idea that the economy is cooling overall. More data will be examined over the coming weeks.

A big concern is the impact of high interest rates on regional banks in the US. While the recent banking crisis might be out of the woods, high rates could add to the banking system’s stress as more regional banks book losses on their bond positions and on their real estate loans.

Lastly, we expect the US Fed to keep a close watch over the political debt ceiling standoff. The stand-off between the two main political parties over the debt ceiling raises the prospect of a default by the US government over the coming weeks.

A big concern is the impact of high interest rates on regional banks in the US. While the recent banking crisis might be out of the woods, high rates could add to the banking system’s stress as more regional banks book losses on their bond positions and on their real estate loans.

While we do not envisage a default, investors face increasing risks in financial markets as the June deadline approaches. The uncertainty created by this situation could lead to a decrease in investor confidence and sell-offs of financial assets.

Additionally, this could pose a credit-rating downgrade, further eroding investor confidence. Hence, any further rate hike could pose more damage to the economy.

On balance, we believe that the US Fed is likely to pause rate hikes at its next meeting in June. According to the CME FedWatch Tool, the market expects an 82% chance of rates being held at their current level.

Since the US Federal Reserve embarked on its hiking campaign, Nigerian dollar bonds have seen yields expand rapidly. For instance, the yield of a 2025 Nigerian Eurobond rose from 4.02% to 11.96% (+793bps).

Expectations of a pause in rate hikes and then a rate cut later in the year imply US bond rates are likely to fall later in the year, and therefore that FGN bond rates are likely to moderate, other things being equal.

Analysis is provided by Coronation Research

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com