TUE, SEPT 26 2023-theGBJournal |What is the connection between rising US market interest rates and the investment outlook for Nigerian savers?

The obvious answer lies in the eurobond market where the yields of Nigeran government bonds remain far higher than the yields they were issued at.

Take the sample of six Federal Government of Nigeria (FGN) eurobonds featured on this page, and simply compare their current yields with the coupons given with their names.

Current yields are much higher than coupons (the coupons represent the yields available at par value when they were issued). On average current yields are 3.42 percentage points (342bps) higher than the coupons.

The fact that yields have risen over time suggests that investors view these bonds as riskier than when they were issued.

Yet risk is not the whole story: far from it. The benchmarks for all US dollar-denominated bonds are the US Government’s own bond yields, and these have been rising, too.

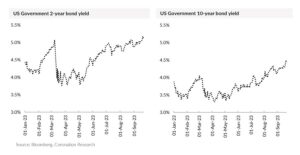

The yield on the US Government’s 2-year bond has risen by 0.67 percentage points (67bps) from 4.43% to 5.10% so far this year, while the yield on its 10-year bond has risen by 55bps from 3.87% to 4.42%. These rises set the hurdle a little higher for FGN eurobond yields.

Yet the yields of our sample of six FGN eurobonds have all fallen this year, on average by 78bps. Clearly, investors’ opinions of Nigerian risk have improved since the beginning of the year, despite the ballooning of Nigerian public sector debt.

The realization of Nigeria’s ballooning public sector debt was largely a function of adding the Central Bank of Nigeria’s so-called ‘Ways and Means’ loans (which are in Naira) to the FGN’s total debt.

Analysts at Coronation Merchant Bank Economic Research also discussed it in their publication Significant Rise in Public Debt Stock, 22 September. The rise was not a surprise and Nigeria’s debt/GDP ratio is still much better than many comparable nations.

All the same, it is noticeable that FGN eurobond yields have tracked up somewhat since mid-August, by some 0.44 percentage points (44bps) across our sample

Twitter(X)-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com