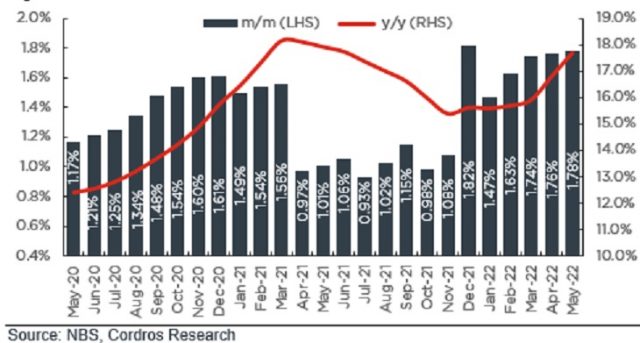

THUR, 16 JUNE, 2022-theGBJournal| According to the recently released data from the National Bureau of Statistics (NBS), headline inflation increased by 89bps in May to 17.71% y/y (April: 16.82% y/y) – the highest print since June 2021 (17.75% y/y). The elevated inflationary pressure is consistent with the broad-based increase across the food (+113bps to 19.50% y/y) and core (+72bps to 14.90% y/y) inflation baskets.

We highlight that the outturn is 15bps higher than Cordros’ estimate (17.56% y/y) and 21bps higher than Bloomberg’s median consensus estimate (17.50% y/y). On a month-on-month basis, headline inflation rose slightly by 2bps to 1.78% (April: 1.76% m/m).

Food inflation surged by 113bps to 19.50% y/y – its highest print since September 2021 (19.57% y/y). Asides from the unfavourable base effects from the prior year, the elevated food prices reflect the (1) lingering spillover effect of higher transport costs and (2) below-average dry season harvest.

Moreover, imported products, including wheat and fertilizer prices, remain elevated amidst the Russia-Ukraine conflict. Accordingly, there was a broad-based increase across the Farm produce (+104bps to 19.99% y/y), Processed food (+115bps to 19.35% y/y) and Imported food (+9bps to 17.75% y/y) sub-baskets.

On a month-on-month basis, food inflation increased slightly by 1bp to 2.01% m/m giving credence to our view that the base effects from the prior year’s corresponding period fanned higher food prices amidst pre-existing constraints.

Elsewhere, core inflation (+72bps to 14.90% y/y) maintained its uptrend for the second consecutive month, rising to its highest level since March 2017 (15.40% y/y). The sustained increase in the core basket reflects the effects of high diesel and aviation fuel prices on transportation and production costs.

Also, we think the lingering currency pressure supported the increase in the core inflation basket as the supply of the US dollar remains limited at the official FX markets. Consequently, there was a broad-based increase across all the sub-baskets under the core index. Notably, Utilities (+77bps to 13.85% y/y) prices rose to their highest level since April 2017 (16.05% y/y), while Transport (+54bps to 16.39% y/y) prices increased to a 64-month high. Similarly, on a month-on-month basis, the core index was up by 65bps to 1.87% (April: 1.22% m/m), in line with the above-mentioned factors.

In June, we expect food prices to remain pressured given the below-average off-season harvest, even as planting activities are underway. Besides, we expect PMS shortages and higher diesel prices to continue to filter into higher food prices. Similarly, we expect the pressure on the core inflation index to remain elevated in line with the lingering increase in energy prices and progressive increase in electricity tariffs amidst the current shortages of PMS in some parts of the country. On balance, we expect the headline CPI to rise by 1.83% m/m, with the unfavourable base effects from the prior year translating to a 90bps increase in y/y inflation rate to 18.61% in June.-With Cordros Research

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com