WED. 30 NOV, 2022-theGBJournal| Last week Coronation Research provided insights on how the total return of their Model Equity Portfolio was some 4.79 percentage points (479bps) higher than its share price return, which is broadly what would be expected from the NGX All-Share Index as a whole.

The total return is given by receiving dividends from a stock and reinvesting them immediately. The next question the research services arm of Coronation Asset Management Ltd is asking is: “Which of the top-20 stocks in the NGX All-Share Index have provided the best total return, year-to-date?”

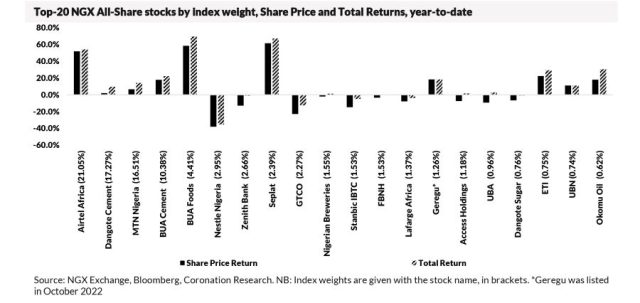

The answers are, in descending order for the top five returners: BUA Foods, whose total return year-to-date has been 69.4%; Seplat, with 67.2%; Airtel Africa with 54.1%; Okomu Oil with 30.5% and ETI with 29.4%.

In most of these cases the underlying share price performance has been the main driver of the total return. Airtel Africa, for example, has delivered 51.8% in share price return, year-to-date, and 54.1% in total return.

In other cases, the payment and reinvestment of dividends has made a material difference, as in the case of BUA Foods whose share price return, year-to-date, has been 58.5% but whose total return has been 69.4%.

In terms of total return, Okomu Oil is the outlier among the top five returners. Its share price return, year-to-date, has been 18.0% but its total return has been 30.6%, 12.6 percentage points higher. Okomu Oil has been generous this year (a peak year for palm oil prices), paying a dividend of N8.0/share in May, a further N7.0/share in August and N2.0/share more in November.

It makes sense to separate out share price returns from total returns in order to identify generous dividend payers. In the next table we take the top-20 stocks in the NGX All-Share Index by index weight and arrange them by their excess total return over their share price return (total return minus share price return).

When we commenced this part of the study, we thought the results would feature mainly bank stocks, as banks are typically generous dividend payers. In fact, there are as many non-banks as banks among the top scorers. Okomu Oil, BUA Foods, MTN Nigeria, Dangote Cement, Dangote Sugar and Seplat are the industrial stocks, among the top-20 index weights, whose total returns have exceeded their share price returns by five percentage points or more, so far this year.

It would be tempting to build a portfolio around these stocks. After all, generous dividend payers are generally profitable companies. The problem one might encounter is liquidity. The top-five stocks which we measure by excess return over share price return (Okomu Oil, UBA, Zenith Bank, BUA Cement and GTCO) account for just 10.92% of the market by index weight.

All the same, it is worth bearing this factor in mind when constructing a portfolio because it may make sense to construct overweight positions accordingly. Investors disproportionately trade stocks with high dividends; trading volumes of banks vastly exceed the volumes in any other sector, despite the six banks in our charts making up just 11.62% of the index. Bank stocks also tend to have high free floats, so there are plenty of available shares to trade.

What can we conclude from the above? Not all generous dividend payers are good performers in terms of stock prices (this is true of most of the banks, so far this year), but when the underlying fundamentals driving a stock are favourable, it makes sense to follow the generous dividend payers and to reinvest.-With Coronation Research.

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email:gbj@govbusinessjournal.ng|govandbusinessj@gmail.com