TUE 22 MARCH, 2022-theGBJournal| Nigeria’s listed cement companies together account for some 30.0% of the NGX Exchange All-Share Index, yet the cement industry itself accounts for just 0.9% of GDP, according to data from the National Bureau of Statistics (NBS). So, is cement’s over-representation on the exchange good or bad? In our view, it is good because cement is growing much faster than GDP overall.

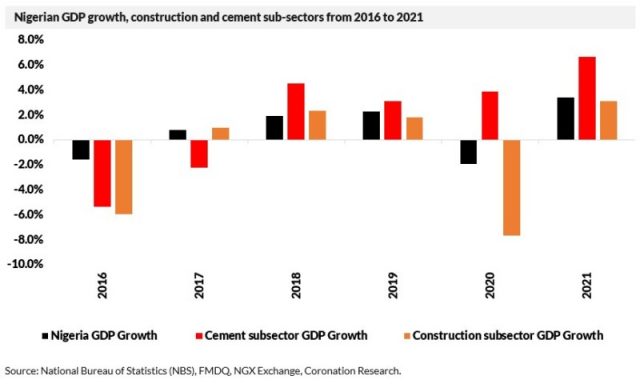

Although the cement sector fared poorly during 2016 and 2017, it has been growing at an average of 4.5% per annum (pa) over the past four years (2018 to 2021) in inflation-adjusted prices, according to the NBS, which is about three times the rate of GDP growth over the same period. It has also been growing much faster than the construction sector.

The construction sector tends to grow when the economy grows and to shrink when the economy contracts. As a result, construction performs very poorly (see the chart entries for 2016 and 2020) when the economy is in recession. By contrast, the cement industry’s performance has very little correlation with the economy overall, even growing during the recession year of 2020.

The size of the cement sub-sector gives us an important clue as to why this is so. It is roughly 25% of the size of the construction sector, a percentage that tallies with the cost of building the frame of a building (reinforced concrete beams, blocks) compared with its total build-cost. In other words, it seems that so long as there is enough money around to start a building project, people will do so. The ability to meet the much higher costs of erecting a roof, installing plumbing, windows and electrical wiring is susceptible to swings in the economy, in our view, and can be delayed for years while funds are found.

The next question is, “Where does the money come from in the first place?” After all, almost everyone suffers in a recession, including builders, whether they are large-scale companies or the millions of people who build their own homes. The answer, in our view, is likely to be connected with remittances.

Remittances from Nigerians overseas can be negatively affected by global recession but are nevertheless substantial sums paid directly to family members during good years and bad. If our reasoning is correct, then it would account for the expansion of the borders of cities like Lagos year-in, year-out, and the success of the cement industry.- With Coronation Research analysts

Twitter-@theGBJournal|Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com