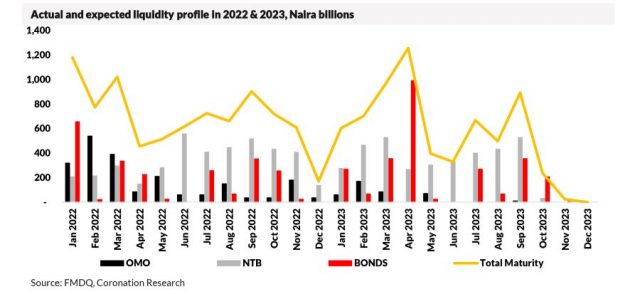

TUE, 08 NOV, 2022-theGBJournal| In the first half of 2002 we saw market interest rates trend downwards with average bond yields falling from 11.50% to as low as 10.28%, and 1-year T-bill yields falling from 5.46% to as low as 3.19%. The plunge in yields was attributable to massive liquidity in the system as a total of N4.56tn-worth (US$10.4bn) of OMO bills, NTBs and FGN Bonds (inclusive of coupons) matured.

Market rates then began an upwards march in the second half of the year as system liquidity tightened. The level of maturing securities is set to fall by 17% to N3.79tn in the second half of this year. This has been a contributing factor to the rise of market interest rates in recent months. The Monetary Policy Rate was hiked three times from 11.5% in early May to 15.5% as of September.

Recall that in a recent Coronation Research note, “Savings rates are rising quickly? (4 October 2022)”, they explained the transmission mechanism between official and market rates, showing how market interest rates responded faster than after the MPC’s first rate hike in May.

A major difference here was the Cash Reserve Requirement (CRR – the percentage of deposits which banks must deposit with the Central Bank of Nigeria) which was increased by 500bps to 32.5% in September. This further tightened liquidity and forced banks to raise deposit rates.

Examining the latest data from FMDQ, Coronation Research estimate that circa N7.57tn worth of T-bills, OMO bills and FGN bonds (including coupons) have matured so far this year out of an expected N8.35tn expected for the full year.

From July, system liquidity tightened as lower volumes of securities matured (save for September, when there was a temporary spike). As of 4 November 2022, the average FGN bond yield was at 14.55%, while 1-year T-bill yield was at 15.31%.

Q4 2022 is now characterised by a low liquidity profile, hence we expect that bond yields could move up again, peaking in December. This prognosis is based on the upcoming liquidity drought (the lowest level of redemptions in 2022) over the coming two months, barring any unanticipated moves by the CBN to influence system liquidity or any other extraneous event that could affect market yields.

By contrast, the first four months of 2023 are to witness massive liquidity inflows from redemptions, similar to Q1 2022. In the context of our expectation that rates are likely to continue going up next year, this could mean that the CBN uses other methods at its disposal (e.g., the MPR, the CRR) to keep rates moving upwards. Alternatively, it may just allow rates to ease off during the first part of the year.

Naturally, visibility going into 2023 is limited, given that general elections are due in February. Beyond the election we note that the levels of redemptions are set to be low during May and June, pointing to low liquidity and renewed upward pressure on rates.

Twitter-@theGBJournal| Facebook-The Government and Business Journal|email: gbj@govbusinessjournal.ng|govandbusinessj@gmail.com