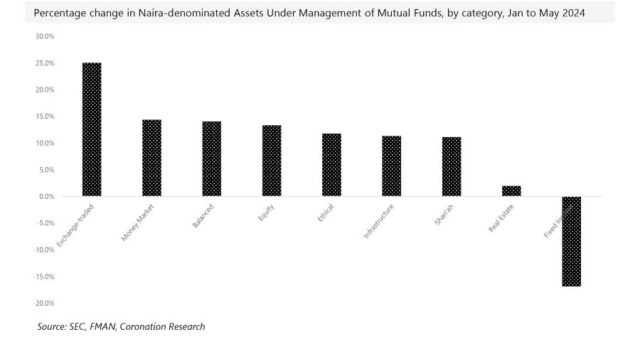

TUE JUNE 11 2024-theGBJournal| Nigeria’s Naira-denominated mutual fund industry grew by 7% in the first five months of 2024, the good news being that Money Market funds grew by 14%.

As T-bill rates hold up in the months ahead, Money Market fund yields are set to improve and attract more money, likely making 2024 a vintage year for the industry.

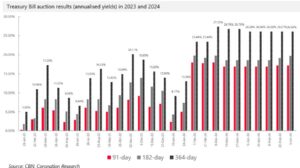

The last 12 months, and particularly the past five months, have seen a transformation in Naira fixed-income yields. Not only are T-bill yields realized at the CBN’s auctions high, they are consistently high.

How has this impacted Money Market funds? Much of the money invested in Money Market funds is used to purchase T-bills; and T-bill yields strongly influence the yields of other securities and deposits which Money Market Funds invest in.

The average yield of 91-day T-bills at auction so far this year has been 15.0%, annualised, as opposed to an average of 5.2% in 2023; the average yield for 1-year T-bill has been 23.3% against an average of 13.3% in 2023.

Historically, high market interest rates have been good for Money Market Funds as savers are attracted by yields. This matters to Nigeria’s fund management industry because Money Market fund make up the biggest slice of its Naira-denominated assets under management (AUM), accounting for 63% of the total.

Note that the yields of Money Market Funds do not move up immediately to match those of T-bills. Money Market Funds hold T-bills from previous auctions that have lower yields than those on offer today, so these need to mature before Money Market Funds fully reflect the yields on offer in the market.

As time goes on (and as long as T-bill rates remain high) the advertised yields of Money Market funds will continue to improve this year.-Analysis is written by Coronation Research and made available to theG&BJournal.

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com