…Our fair value measure of the Naira/US dollar exchange rate, which we described last week, is based on inflation differentials between the two currencies

…The good news is that, in terms of Naira fixed income, 2024 is a much better year that any of the past four (2020 to 2023, inclusive) in terms of what can be earned on T-bills and OMO bills.

TUE MAY 21 2024-theGBJournal|Our recent article on the fair value of the Naira last week, (Update, Fair Value and the Naira, 13 May 2024) prompted questions, particularly from savers.

Should savers use their Naira to buy US dollars at these rates? Should they keep their Naira to earn juicy yields available on T-bills and OMO bills? And should they even sell their US dollars to do this?

While we do not have a crystal ball, it strikes us that each of these strategies imply certain assumptions. So, it is worth trying to describe these. And our measurement of the fair value Naira / US dollar exchange rate helps.

The fair value method revisited

Our fair value measure of the Naira/US dollar exchange rate, which we described last week, is based on inflation differentials between the two currencies.

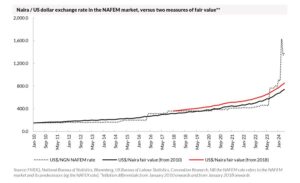

Most readers who commented on last week’s chart (which we reproduce at the end of this article) observed a line trending along a gently upward slope (between N149.5/US$1 in January 2010 and N461.8/US$1 in June 2023) before veering off wildly towards N1,650.0/US$1 in late February 2024.

The scale we used did not help anyone understand the chart.

So, with apologies for that, we present the chart again here, with two modifications. First, we stop the chart in August 2023, just at the point where the exchange rate weakened radically, and this makes the scale of the chart easier to use than before.

Second, we add two dotted lines, one representing values half of one standard deviation below fair value and the other half a standard deviation above fair value. (For a description of our measure of fair value, see last week’s article.)

When we applied the standard deviation measure to the chart, we were astonished. Much as it seems crazy to think of the Naira/US dollar exchange rate as having traded within some kind of range between 2010 and mid-2023, it did.

Half a standard deviation either side of fair value between January 2010 and January 2023 set the range of values within which the NAFEM rate traded.

Even when the exchange rate fell from N199.1/US$1 in June 2016 to N319.8/US$1 in August 2016, the values were within the range.

First conclusion

So, however strange it seems to think of the Naira having traded in a range, we can establish that recent and current values are an aberration, something completely different from the preceding 13 years.

Unfortunately, this does not itself tells us where the currency will trade in three or six months’ time. As we wrote last week: “a return of confidence has the potential to cause the Naira to appreciate considerably: the continued absence of confidence would simply mean prolonged Naira cheapness.” Either outcome remains possible.

Sell Naira to buy US dollars

Now that we can be reasonably ascertain that the current exchange rate is an aberration, it seems that selling Naira to buy US dollars means paying much more than fair value for them.

One might do this because it is necessary (buying foreign-sourced materials is often unavoidable) but to do this as a saver implies several assumptions.

It implies a belief that: the Naira will not appreciate; the Naira will continue to be very cheap in fair value terms; inflation will remain a threat (because of the contribution of imported inflation); foreign-sourced goods and services will continue to be very difficult to afford; companies’ costs are likely to rise due to imported inflation; companies’ profitability is likely to decline.

This is a very bleak economic outlook.

Keep saving in Naira

Another option, for a saver, is to keep on saving in Naira. The good news is that, in terms of Naira fixed income, 2024 is a much better year that any of the past four (2020 to 2023, inclusive) in terms of what can be earned on T-bills and OMO bills.

The bad news is that, while a 1-year T-bill yield at 25.07% is easily double anything achievable last year, it still falls miserably short of the rate of inflation at 33.69% (year-on-year, for April), so the inflation-adjusted return remains negative. FGN bond yields are generally somewhat lower than 1-year T-bill yields.

It might be that one’s mandate, as a Nigerian institution, is to save in Naira, full stop. Or one could adopt a fatalistic view that one is going to make a loss in inflation-adjusted terms, but this is not going to be as bad as it has been in the past, 2020-2023 (surely not a recipe for preserving wealth).

By contrast, the positive decision to save in Naira today implies several things. It implies a belief that Naira inflation will be beaten: the raising of market interest rates at the behest of the CBN will be effective; declining inflation will make the fair value of the Naira look even cheaper than at present; a virtuous relationship will be established between a strengthening Naira and a

decline in imported inflation. This is a rosy economic outlook.

Sell US dollars to buy Naira fixed income

If the option to keep on saving in Naira makes sense, and one accepts that relative to fair value the Naira is exceptionally cheap, then another savings route opens up.

This is to sell US dollars and buy Naira fixed income. After all, US Government bond yields, although at their highest level in decades (see Nigeria Weekly Update, Best US dollar rates in year, 29 April) are much lower than Nigerian fixed income yields.

Taking this route carries all the implications of keeping one’s savings in Naira, plus a belief that liquidity in the foreign exchange markets will continue to improve so that Naira proceeds can be used in future to buy US dollars again.

Beware mean reversion

Of course, the positive case for the Naira/US dollar exchange rate involves the Naira returning towards its fair value range (if not all the way back to its fair value range).

Even though today’s exchange rate is an aberration, there is no guarantee that this will happen. Generally, to take this approach in large, liquid and efficient markets is reasonable (hedge funds were created to do just this) but in small illiquid markets like Nigeria such an approach may be dangerous.

For example, in August 2023 one could have argued that the Naira, at N765.0/US$1, was outside its fair-value trading range, and cheap. Therefore one might have sold US dollars to buy Naira: but the Naira continued to depreciate, reaching N1,650.0/US$1 in late February 2024.

The real world of exchange rates

At the end of the day, currency flows will determine the fate of the Naira/US dollar exchange rate.

As we wrote in Nigeria Weekly Update, Will the foreign investors step forward? It is both foreign portfolio investment, foreign direct investment and trade flows that will determine the exchange rate.-Weekly update is written by analysts at Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com