…Could the Central Bank of Nigeria (CBN) organise a rally in the Naira/US$ exchange rate, using its substantial US dollar reserves, which have been growing lately?

…It is a tempting prospect but, while we do not rule it out, we think it unlikely over the coming months.

TUE OCT 01 2024-theGBJournal| What resources does the Central Bank of Nigeria (CBN) have when it comes to foreign exchange management? The CBN is an important supplier of US dollars to Nigeria’s foreign exchange markets, so the sum of US dollars it holds is relevant to forecasting future Naira/US dollar exchange rates.

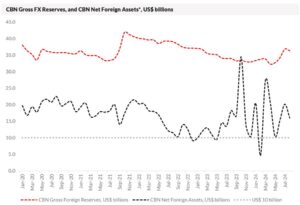

To begin with, the CBN’s position appears to be vastly improved, with its published US dollar gross reserves rising from a low point of US$32.1 billion in mid-April this year to US$37.9bn last week.

Does this mean that the CBN has an extra US$5.8bn with which to intervene in the currency markets? If this were true, then we would have to take the potential for Naira appreciation seriously.

Unfortunately, matters are not as simple as this. The CBN’s gross reserves data represent a three-month moving average and do not provide an up-to-date account of its strength. And, as the namely implies, this is a gross number so it does not reflect the various US dollar liabilities (such as FX swaps owned to banks) which the CBN carries.

A much better number, in our view, is that for the CBN’s Net Foreign Assets, published monthly. If we take this number, which is given in Naira, and divide it by the Naira/US$ NAFEM rate for the last day of each month, we arrive at a net US dollar figure.

In our charts here we show this value and also present a line showing US$10.0bn, because we think that the US$10.0bn-mark for net foreign assets may be significant.

In December 2021 the CBN’s net foreign assets were high, at some US$21.5bn. They then declined to just US$10.3bn nine months later, in September 2022, according to our calculations. Then they rallied twice, falling thereafter each time, until they touched US$9.5bn in May 2023.

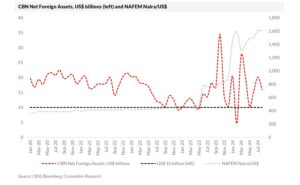

This period was one of: (a) moderate Naira/US$ depreciation in the NAFEM market (under the ‘managed exchange rate’ policy of the previous CBN administration), (b) a build-up of overdue foreign exchange transactions owed to airlines, shipping companies, foreign investors and other parties, (c) significant depreciation of the Naira in the parallel market, far removed from the NAFEM rate; (d) and a build-up, according to press reports such as Reuters, of US dollar payables owed by the Nigerian National Petroleum Company (NNPC). This last factor is significant and we shall return to it.

Our point is that, by May 2023, the CBN may well have believed that it had limited room for manoeuvre in the foreign exchange market. The decision, soon afterwards, to float the Naira/US$ exchange was a change in long term strategy, but it coincided with a low point in the CBN’s net foreign assets.

The obvious feature of our chart is how volatile the net foreign asset position has been since May 2023. This can be explained. The floating of the currency and the partial removal of fuel subsidy in mid-2023 saved a great many US dollars and the net foreign assets figure climbed rapidly.

Then the authorities settled the backlog of FX transactions with airlines, shipping companies, foreign investors and other parties, taking net foreign assets down again. This pattern has been repeated several times.

It is not clear to us whether the NNPC’s obligations are already reflected in the net foreign assets of the CBN – we assume that they are not. Either way, N16.0bn is not a particularly high number for the CBN’s net foreign assets and it appears probable that the CBN may need to wait a while before receiving its usual flow of US dollar from the NNPC.

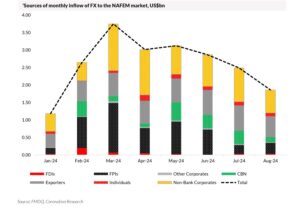

This matters because, as mentioned above, the CBN is an important provider of US dollars to the NAFEM market, providing some 10.0% of its total inflow of US$20.9bn over the first eight months of this year.

Given the decline in the FX flows into the market recorded between March and August, and given the steep fall in contributions from Foreign Portfolio Investment over the same period, perhaps now would be an opportunity for the CBN to supply substantially more US dollars.

But we doubt that now is a good time. A strong intervention from the CBN may come, eventually, but it does not seem likely in the short term.-Analysis is written by Coronation Research analysts and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com