…The investment outlook for Naira fixed income investments (T-bill, FGN bonds) remains unclear.

…Yields are well below the rate of inflation and investors are not rewarded very much for taking duration (i.e. buying long-dated FGN bonds as opposed to short-dated ones).

TUE, OCT 10 2023-theGBJournal| Six months on from the announcement of President Bola Ahmed Tinubu’s victory in presidential elections, what is the state of Nigeria’s financial markets and where are they headed? It is helpful to re-read what we published at the beginning of March.

The All Progressives Congress (APC) manifesto, which we took as a roadmap for future policy, gave readers little warning of the radical reform agenda the President would soon unleash.

The manifesto was about, to paraphrase it quickly: going for economic expansion; achieving 10.0% per annum GDP growth; increasing government expenditure. So, we favoured Dangote Cement as a key stock to invest in the growth theme, food manufacturers, and the bank sector.

Then came the welcome news of a radical reform agenda, the first big announcement coming during the President’s inaugural address at the end of May. This was the ending of fuel subsidies (note that this was included in the APC manifesto: few people thought it would actually happen).

It was time for us to change our investment tactics. Coronation Research wrote in Investment Opportunities from Fuel Subsidy Removal, 9 June, that the benefits were clear for Federal Government of Nigeria Eurobonds (the FGN would have more US dollars with which to service them) and for mid-stream petroleum companies (thanks to unregulated margins): but the situation was worrying for the consumer (rising inflation) and therefore food manufacturers and brewers.

Soon came the announcement of liberalising foreign exchange markets and the partial free-market float of Naira/US dollar exchange transactions.

The consequences were clear, as also expressed by Coronation Research in their note, Investment Opportunities from FX Liberalisation, 10 July, namely that the listed banks were prime beneficiaries.

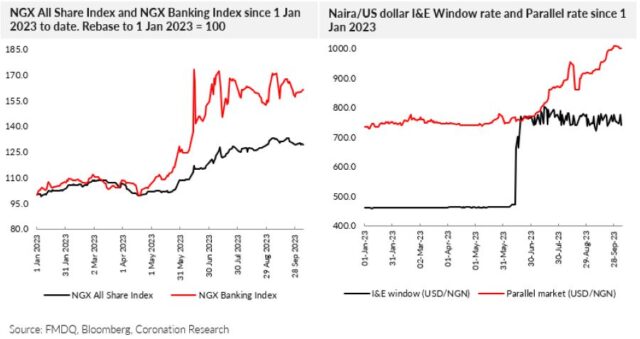

The beauty of listed equity markets is the ability to switch between stocks quickly. Our initial preference (in March) for Dangote Cement did not do too badly (up 18.8% year-to-date and up 11.6% since the beginning of March), but the banking sector did much better (up 61.9% year-to-date, up 44.8% since the beginning of March, and up 11.3% since mid-July).

At the same time, these two key reforms have not run their course. There are still separate Importers & Exporters window and parallel market foreign exchange rates, and fuel subsidies seem to continue to some degree. Does this mean that the reform agenda has stalled and that we must revise our judgments again?

We think not. What has happened, in our view, is that these two key reforms have encountered more problems than initially envisaged, but they are not being abandoned. The backlog of demand of US dollars may not have been fully understood at the time the new policy was implemented.

The rise in petroleum prices, initially from N184.0/litre to N488.0/litre (in Lagos), was exacerbated by the rise in the price of crude (Brent crude rose from US$72.7/bbl at the end of May to US$84.6/bbl at the end of last week), rising to N620.3/litre (in Lagos, on average) in August.

At the end of last week we saw prices in Lagos around the N578/litre mark while unregulated diesel traded at N980/litre.

The government is not back-tracking on its reforms. Measures to soften the impact of reforms are being rolled out, but the basic policy stance has not altered (despite many pleas for a change in policy).

The only area in which we still wait for direction is Naira interest policy, which for fixed income investors is a large part of the jigsaw that is still missing. Note that, just as in 2022, fixed income rates have changed only slightly so far this year, moving slightly upwards.

Why do we not have an interest rate policy in place? This is largely due to the lengthy process of appointing a new Governor of the Central Bank of Nigeria, who only took office a few weeks ago.

The Governor does not inherit an easy hand to play, far from it. The decision whether to pursue an interest rate policy designed to rein in inflation (and, if so, how aggressively to raise market interest rates), or whether to continue with market interest rates well below the rate of inflation (as they have been since the fourth quarter of 2019), is not an easy one.

Fixed income investors with liquid assets would undoubtedly favour raising rates: the problem would be the effect on the cost of borrowing and its effect on the economy.

Looking Forward

Therefore, the investment outlook for Naira fixed income investments (T-bill, FGN bonds) remains unclear. Yields are well below the rate of inflation and investors are not rewarded very much for taking duration (i.e. buying long-dated FGN bonds as opposed to short-dated ones).

Even deposit rates (which can be arranged by asset management companies on behalf of clients) are reasonably attractive for investors that have a short-term investment horizon when compared with T-bill and bond rates. And a good reason to have a short-term investment horizon is that rates may go up.

While rates remain below the level of inflation, risk is still in fashion. Equities are still performing well (although we think most of the heavy lifting of the NGX Exchange All-Share Index has been done already this year) and risk products still get investors’ attention.

What investors need to understand is that they may need to change tactics again this year. Keep your options open.- Analysis is provided by Coronation Research.

Twitter(X)-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com