THUR. 06 APRIL 2023-theGBJournal | Coronation Research, a subsidiary of Coronation Asset Management company, in their latest report on Nigerian Banks, ”A year of Resilience and Grit,” recommends Zenith Bank, GTCO, Access Holdings, UBA and Stanbic IBTC for ‘’BUY’’ and placed FBNH on ‘’HOLD.’’

Coronation believes Nigerian banks currently trade at significant discounts to peers and thus offer an attractive entry point with a further case made by attractive dividend yields.

They expect modest earnings growth from the featured banks, driven by rising interest rates, a strong contribution from non-interest revenue derived from FX revaluation gains, and growth in non-bank businesses and digital banking.

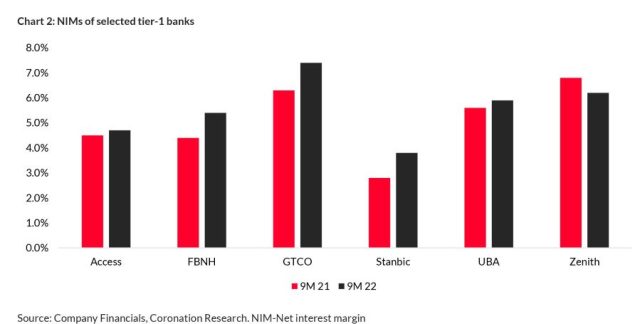

According to Coronation Research, ‘’We believe the impact of rising yields will vary across the banks, depending on each bank’s ability to reprice its loan book and the composition and contribution of interest-earning assets. Given the sticky nature of loan yields, we favour banks with large exposure to investment securities in this regard. Lastly, we think banks with low-cost deposits are likely to benefit on a net basis.’’

Another fillip for the banking sector is the adoption of the HoldCo structure, which four of the banks covered in the report have already adopted (Access Holdings, FBN Holdings, Guaranty Trust Holding Company, and Stanbic IBTC Holdings) and which will be adopted by a further one (Zenith Bank).

‘’The HoldCo structure gives banks opportunities in sectors such as pensions, fund management, the trustee business, venture capital, private equity, insurance and stockbroking. Increasingly, bank-holding companies are making profits from non-banking businesses.’’

Several banks have been establishing their presence outside of Nigeria. The case for diversifying geographically is evident in the varying macro environment of each country. ETI (not covered in this report) and UBA have developed the most international franchises, operating out of 14 and 20 African countries, respectively.

UBA’s non-Nigeria subsidiaries contributed 63% to the group’s Profit Before Tax (PBT) over the past three years. GTCO’s non-Nigerian subsidiaries have also fared well, contributing 23% to the group’s PBT over the past three years.

Access Holdings’ expansion drive has also been paying off with its non-Nigerian subsidiaries contributing 39% to the Group’s PBT overthe past three years.

Rationale for Recommendations

Access Holdings

Ambitious growth to pay-off

Access recently closed out on its 5-year corporate strategy spanning 2018–2022 and we can say to a large extent that it has achieved its goals. As part of its drive to establish a strong franchise outside of Nigeria, the bank now has 12 subsidiaries throughout Africa, which together contributed 22% to the group’s PBT as at 9M 2022 (FY 2017: 16%). In addition, it has grown its asset and deposit bases by a CAGR of 28% and 30% respectively over this 5-year period.

The group has new ambitions for the period 2023–2028, namely to further expand and solidify its presence outside of Nigeria, leveraging its Holdco to diversify revenues in the areas of consumer lending, payments, insurance, asset management and pension fund management. We believe this diversification is set to improve earnings, particularly from its consumer lending and its pensions business, in which it aspires to attain a top-10 position by 2023 (currently #12).

We forecast earnings to grow by 13.7% and 14.9% in 2022E and FY 2023F, respectively, with average RoAE over 2023F– 2027F settling at 17.2%. We have a target price of N13.43 per share, which implies potential upside of 50.9%. Consequently, we have a BUY rating on the stock.

FBN Holdings

Higher growth on the back of improved asset quality FBNH has come a long way from a bank struggling with large asset quality issues (FY 2018 non-performing loans: 25.9%) to keeping them under control (9M 2022 NPL: 4.7%). We expect this to keep its impairment charges in check in FY 2022E and FY 2023F. For FY 2022E the bank is set to record the highest level of Net Interest Income since FY 2017, supported by a strongly-performing loan portfolio. We believe that the rise in the yield environment over the year is likely to be accretive to its NIM expansion given its low-cost deposit profile. We expect support from its international subsidiaries and non-bank subsidiaries. We expect a 10bps y/y expansion in its NIM during FY 2023F driven by growth in asset yields.

Elsewhere, we expect strong performance in the bank’s digital banking business and its wealth management subsidiaries also to support earnings over the year.

That said, we are cautious about its capital base, which stands at 17.8% as at 9M 2022. We believe this could restrict credit growth over the year.

We expect net earnings to grow by 10.2% in FY 2023F with an average ROAE over 2023F–2027F settling at 12.9%. We have a target price of N13.21 per share, which implies potential upside of 18.5%. Consequently, we have a ‘’HOLD’’ rating on the stock.

Guaranty Trust Holdings

A choice in a tight period

Over recent quarters, Return on Average Equity for GTCO seems to have peaked following slow growth in its asset base and lacklustre earnings performance. However, we see a degree of change in this trend going forward following management’s adoption of the HoldCo structure. We believe its payments subsidiaries (Habaripay) and its PFA are set to enable the Holdco to diversify earnings and multiply cross-selling opportunities.

Our forecasts for GTCO assume low impairment charges and adequate cost control. We believe management will be able to exploit the increase in yields given the bank’s high proportion of investment securities and its low-cost deposit base (9M 2022 CASA: 86.6%).

We expect earnings to grow by 4.3% and 10.0% in 2022E and 2023FY, respectively, with average ROAE over 2023F–2027F settling at 23.6%. We have a target price of N32.43 per share, which implies a potential upside of 29.2%. Consequently, we have a BUY rating on the stock.

Stanbic IBTC

Earnings outlook tilting towards an upside

Stanbic IBTC was one of the first banks to adopt a Holdco structure and it now runs well-established corporate banking and asset management businesses with its retail banking segment growing rapidly. After taking a hit on its trading revenue line in FY 2021 due to low trading activities post-Covid, we expect to see improved trading gains in 2023F due to elevated fixed income trading activities and FX spreads.

We anticipate an expansion in NIMs owing to strong credit growth and an elevated rate environment. Given the large contribution of its foreign currency (FCY) loans (51%), we also see room for revaluation gains on the back of potential Naira depreciation. We see limited asset quality issues on its loan book over the year.

Overall, we like Stanbic IBTC’s diversified business model and its recent announcement of a fintech subsidiary. We expect management to take advantage of cross-selling opportunities among its business segments.

We forecast earnings to grow by 21.2% in FY 2023F with average RoAE over 2023F–2027F settling at 26.5%. We have a target price of N44.30 per share, which implies potential upside of 17.8%. Consequently, we have a BUY rating on the stock.

UBA Group

Earnings to weather the storm

UBA has been able to leverage its pan-African status to diversify its earnings, with the effect that earnings can be cushioned from the effects of macro-economic problems in one country. Over the past three years, its Rest of Africa subsidiaries have contributed 63% to group PBT. The bank has been able to solidify its position facilitating trade across the continent.

We expect its trade income line to contribute circa 18% of total fee income in FY 2022E.

We like the strong performance in the bank’s digital business revenues, which is second only to that of Ecobank Transnational Incorporated (ETI), but we are concerned about its high digital expenses which erode most of its gain. We believe that the market would like to see an improvement in reducing these expenses.

We expect NIMs to remain steady due to management’s ability to reprice rates on its loan book quickly. However, we are concerned about its loan and investment securities portfolio in Ghana following the country’s recent crisis. Thus, we expect to see some pressure on asset quality and consequently an elevated impairment charge. Overall, we believe that strong gains in interest income and fees are likely to counteract worries over its asset quality over time.

We expect earnings to grow by 28.9% and 26.0% in 2022E and 2023FY, respectively, with average RoAE over 2023F–2027F settling at 17.6%. We have a target price of N11.5 per share, which implies potential upside of 43.8%. Consequently, we have a BUY rating on the stock.

Zenith Bank

A compelling value proposition

Zenith Bank has effectively played the traditional banking approach until now, and we sense that this has worked well. Now, management is seeking to adopt a Holdco structure and it has recently obtained approval-in-principle from the CBN. We look forward to seeing management’s plans regarding how it intends to maximize the benefits of Holdco status.

That said, the bank has been able to effectively source low-cost deposits from its growing retail business and deploy the same to its corporate segment. We expect this, together with its growing earning asset base, to preserve NIMs. Also, management has been working on shifting from non-sustainable non-interest revenue lines to improving its funded income. The contribution of interest income to total revenue increased from 58% in 2021FY to 59% in 2022FY.

Elsewhere, management looks to expand its retail and digital footprint as well as optimise its treasury business. Given the large proportion of its FCY loans (40% of total loans as at 2022FY), we also expect to see some FX revaluation gains during 2023F owing to potential Naira depreciation.

Like UBA, we expect some asset quality pressure from Zenith Bank’s subsidiary in Ghana. But, we believe, the bank is sufficiently well-capitalized (2022FY tier 1+2 CAR, 19.8% ) to withstand such a shock.

We forecast earnings to grow by 19.8% in 2023FY with average RoAE over 2023F–2027F settling at 16.8%. We have a target price of N33.08 per share, which implies potential upside of 32.3%. Consequently, we have a BUY rating on the stock.

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.ng| govandbusinessj@gmail.com