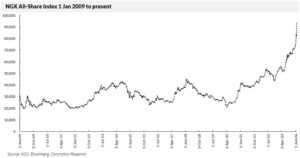

…The direction of the market in January over the past 15 years has been a pretty good indicator (80% of the time) as to its direction for the full year

…This year’s rally has delivered 26.4%, so far

TUE, JAN 23 2024-theGBJournal| Over the past fifteen years (2009-2023, inclusive) there have been nine January rallies (60% of the time).

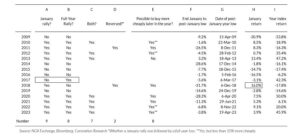

Of these nine January rallies seven of them (78%) went on to develop into full-year rallies. On only two occasions, 2011 and 2018, did the January rally give a false indication of where the market was headed for the full-year.

And on only one occasion, 2017, was there a bear market in January which turned into a bull-run for the full year (see the box within the table, columns A and B). On all the other occasions when there was a bear market in January there was bear market over the full year (five out of six occasions, or 83%).

The direction of the market in January over the past 15 years has been a pretty good indicator (80% of the time) as to its direction for the full year. The two years, 2011 and 2018, when the market rallied in January but gave a negative return for the full year, were exceptions.

In 2011 the market was depressed by news of a single non-performing loan owed by a fuel marketing company to several banks (these were the days before large telecom listings and banks accounted for a large part of the index).

In 2018 the January rally followed a spectacular rally in 2017 (+42.3%): the market thought that the trend would continue, but it came back down to earth.

If there is a January rally (almost certain this year), should investors take profits at the end of January and reinvest later on?

In other words, how often is it possible to buy more cheaply later in the year? The answer is that, after the nine January rallies (between 2009 and 2023) it was possible to buy the market more cheaply on eight occasions (89%) later in that year.

That, on the face of it, would point to selling now with the intention of buying more cheaply later this year.

But only on the face of it. The problem with this analysis is that, on half of these occasions (four) the market did not fall by very much (by less than 10%, see the double asterisks in column E) between the end of January and its low point for the year.

It would have needed a trading genius to sell and then time the second round of purchases. It would have been a better strategy to hold onto the stocks and gather dividends, particularly if one reinvested them.

On this basis, the proper answer to whether investors should take profits at the end of a January rally and invest later is, “Yes, half the time,” which is, of course, a perfectly useless answer.

Volatility may provide a guide as to what to do now. The average January rally over the past 15 years delivered 8.1%, the biggest (highlighted in the box in column H) delivered 16.0%.

This year’s rally has delivered 26.4%, so far. Surely this provides investors with an incentive to take profits? Volatility is not the same thing as risk, but a lot of volatility can lead to risk, e.g. if it encourages a correction.

It is not impossible for the market to lock a large gain in January and continue to rally (look at 2013, for example) but for this to happen in 2024 valuations would have to rise much higher than their recent trend.

As analysts we try to make as few binary (up/down) judgments on markets as possible: we prefer to buy undervalued assets and to wait. At least we can say that investors need to be aware of the risks of a correction and be prepared forit. Analysis is provided by Coronation Asset Management (Research),

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com